Persistent Systems Q2FY25 Earnings: Profit Rises by 23.45% YoY

Company Overview

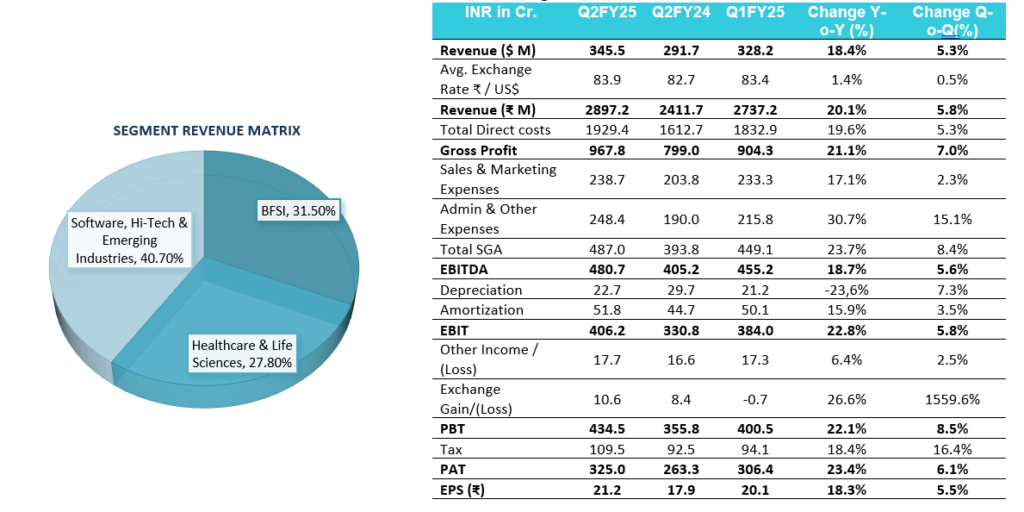

Persistent Systems, incorporated in 1990, is a global software and technology services company specializing in product engineering and digital transformation. The company has demonstrated expertise in emerging technologies, focusing on IoT products, platform development, and strategic partnerships with leading product companies. With a strong presence across sectors like industrial machinery, healthcare, Smart City, and smart agriculture, Persistent delivers solutions that span the entire product lifecycle. In its recent quarter, the company reported $345 million in revenue, marking 18.4% year-on-year growth and 5.3% sequential growth, with key contributions from Healthcare and Life Sciences (up 71.2%) and BFSI (up 15.3%). Persistent continues to drive growth, leveraging advanced technologies like AI and maintaining 18 consecutive quarters of growth.

Industry Outlook

The outlook for the IT sector in FY25 looks promising, with macroeconomic headwinds expected to subside, leading to improved earnings visibility. After outperforming the Nifty in the previous year, the IT sector is likely to maintain its momentum, benefiting from a lower base and easing headwinds. For Persistent Systems (PSL), the company is well-positioned to seize growth opportunities in digital technologies, thanks to its strong product development capabilities and early recognition of digital trends. Management is optimistic about achieving industry-leading revenue growth in FY24, driven by broad-based demand across various sectors, robust deal bookings, new client additions, and incremental revenue from acquisitions. PSL’s leadership in outsourced product development, long-standing client relationships, and end-to-end service offerings position it to capitalize on emerging opportunities effectively. With a strong presence in North America, Europe, and other regions, Persistent is expected to benefit from global digital transformation trends. Its focus on capability-led acquisitions, particularly in Europe, may help it capture new opportunities in consolidating markets.

Persistent aims to maintain industry-leading growth while optimizing margins by 200–300 basis points. Its focus on scaling advanced services, such as AI, and leveraging its robust pipeline suggests a strong performance in FY25.

Business Segments

- Healthcare and Life Sciences:

- This segment has experienced significant growth, with a year-on-year increase of 71.2%.

- The growth is driven by expanding digital transformation initiatives in healthcare, including IoT applications and data analytics.

- Banking, Financial Services, and Insurance (BFSI):

- The BFSI sector recorded a 15.3% year-on-year growth. Persistent’s focus on AI adoption and digital services in financial operations is enhancing customer experience and operational efficiency.

- Technology and High-Tech:

- Although growth in this segment has been relatively slower, management expects an uptick in the next few quarters as demand increases. Investments in innovative technologies and strategic partnerships are expected to drive future growth.

Key Subsidiaries and Their Information

Persistent Systems has multiple wholly owned subsidiaries, with presence in over 20 countries.

- Persistent Systems Inc.:

- This North American subsidiary plays a critical role in driving growth, especially in the healthcare and BFSI sectors. The company is focusing on enhancing its digital offerings and has been successful in securing large deals.

- Persistent Systems UK:

- Focused on the European market, this subsidiary has been pivotal in expanding Persistent’s presence in Europe. It emphasizes product engineering and digital transformation services, catering to various industries, including automotive and finance.

- Acquisitions and Partnerships:

- Persistent has made several acquisitions to bolster its technology stack. For instance, the acquisition of MetaLogix has strengthened its capabilities in data management and analytics. Partnerships with leading technology companies enhance its service offerings, particularly in AI and cloud services.

- Focus on Emerging Technologies:

- Persistent’s subsidiaries are investing in emerging technologies like IoT, AI, and blockchain to enhance their service offerings and provide innovative solutions to clients. The company employs a global delivery model that leverages talent from various regions, ensuring cost efficiency and high-quality service delivery. With macroeconomic challenges easing and increased demand for digital transformation services, subsidiaries of Persistent Systems are well-positioned for sustained growth. The management is optimistic about capturing a larger market share in the digital services landscape, particularly with their strong track record in OPD.

Q2 FY25 Highlights

- Revenue growth: PSL reported $345.5 million in revenues, up 5.1% q-o-q in constant currency (CC) terms beating our estimates of $342 million. Revenue in USD terms was up 5.6% q-o-q/18.4% y-oy while revenue in rupee terms stood at Rs. 2,897 crores, up 5.8% q-o-q/20.1% y-o-y. Growth was led by Healthcare & Lifesciences and BFSI verticals. Persistent reiterated its aspiration to achieve $ 2 billion revenue target by FY27. Management would endeavor to maintain utilization at 83-85%.

- EBIT margins: EBIT margins was flat q-o-q at 14% slightly beating our estimates of 13.9%. Margin headwinds comprising of wage hike (-210 bps), absence of policy rationalization present in Q1 (-130 bps), Incremental impact of fresh ESOP issuance in Q2(-60 bps) and lower earnout credit (-60 bps) was neutralized by margin tailwinds comprising of Utilization (+120 bps), Sub contractor cost reduction (+70 bps), lower resale business (+50 bps), Pricing and right shoring (+130 bps), favorable currency (+30 bps) and absence of H-1B visa cost (+60 bps).

- Order bookings: In the latest performance metrics, Persistent Systems reported a Total Contract Value (TCV) of $529 million, reflecting a 14% increase quarter-over-quarter (q-o-q) and a 10% increase year-over-year (y-o-y). The company achieved a book-to-bill ratio of 1.5x, up from 1.4x in Q1 FY25. New Business TCVs were particularly strong, reaching $389.8 million, which marks a 25% increase q-o-q and a 24% increase y-o-y. The Annual Contract Value (ACV) totaled $348.3 million, showing a modest 3% increase q-o-q and a more robust 10% increase y-o-y. Additionally, New Business ACV reached $218.6 million, reflecting a 10% increase q-o-q and a 19% increase y-o-y. These figures indicate a healthy growth trajectory for Persistent Systems, driven by strong demand and successful business strategies

- Top clients & Client additions: Revenue from the top-5 clients, top-10 clients, top-20 clients, and top-50 clients grew 7.7%/ 5.3%/5.7%, and 5.4% q-o-q, respectively. Persistent added two clients in the $10mn+ and four clients in the $1mn+ revenue category sequentially.

- Headcount & attrition: Net headcount additions declined by 282, taking total headcount to 23,130. TTM attrition inched up by 10 bps q-o-q to 12%. However, utilization improved 270 bps q-o-q to 84.8%.

- Cash generation & DSO: Cash & investments stood at Rs 1791.6 crore, down 6.2% q-o-q. DSO stood at 68 from 67 in Q1FY25. Operating cash flows to PAT for Q2FY25 was 108.3% compared to 49.3% Q1FY25.

SWOT Analysis of Persistent Systems: Key Insights for Strategic Growth

Strengths:

- Expertise in Digital Transformation – Persistent Systems excels in cutting-edge digital transformation services, providing a strong competitive edge.

- Consistent Growth – The company has demonstrated steady revenue growth, reinforcing its position in the global market.

- Robust Deal Wins – Regular success in securing high-value contracts underscores its reliability and industry relevance.

- Global Presence – A well-established presence across North America, Europe, and other key regions, giving it a broad market reach.

Weaknesses:

- Dependence on BFSI and Healthcare – Heavy reliance on these sectors may limit diversification, posing a potential risk in times of industry slowdown.

- Smaller Size – Compared to some industry giants, Persistent Systems operates at a smaller scale, which may impact market dominance.

- Flat Margins – Margins have remained relatively stagnant, highlighting the need for cost optimization and efficiency improvements.

- Integration Challenges from Acquisitions – Ongoing acquisitions pose potential hurdles in seamless integration, impacting short-term operational efficiency.

Opportunities:

- Rising Demand for AI and Digital Transformation – The increasing adoption of AI and digital services presents lucrative growth opportunities.

- Healthcare and BFSI Expansion – Expanding its footprint in the rapidly growing healthcare and BFSI sectors can drive significant revenue.

- Focus on Cloud and IoT Solutions – With businesses globally shifting to cloud and IoT platforms, Persistent is well-positioned to capitalize on this trend.

- European Expansion – The company’s increasing focus on Europe offers new market opportunities, especially in digital transformation and engineering services.

Threats:

- Global Economic Uncertainty – Economic fluctuations could negatively impact client spending and growth projections.

- Competition from Industry Leaders – Larger competitors with greater resources and market share could pose a threat to Persistent’s expansion efforts.

- Currency Fluctuations – Persistent’s global operations expose it to currency exchange risks that could affect profitability.

- Cybersecurity Threats – As digital services grow, so do cybersecurity risks, requiring constant vigilance and investment to safeguard client data.