Welspun Enterprises Q2FY25: Net Profit Declines 11% to ₹61.56 Crore

Company Overview

Welspun Enterprises Ltd, originally known as MSK Projects (India) Ltd, is an Indian company specializing in civil construction contracts and infrastructure projects. Founded on December 20, 1994, the company initially operated as a partnership under the name M.S. Khurana since 1976, before being rebranded as MSK Projects (India) Ltd in 1995. The company later went public in 2004 with an IPO, listing its shares on the BSE, NSE, and VSE. In 2010, it was renamed Welspun Projects Ltd and eventually became Welspun Enterprises Ltd.

Welspun Enterprises engages in a broad range of civil construction projects, such as residential townships, multi-story buildings, industrial plants, and infrastructure development. The company has executed large-scale industrial projects for sectors like petrochemicals, fertilizers, pharmaceuticals, and mining, primarily through Build-Operate-Transfer (BOT) models. It has also expanded into water distribution and surface transport projects, with a significant water supply project underway in Dewas, Madhya Pradesh.

Welspun Enterprises has formed strategic subsidiaries, including MSK Projects (Himatnagar Bypass) Pvt Ltd, Super Infrastructure & Toll Bridge Pvt Ltd, and MSK Projects (Kim Mandvi Corridor) Pvt Ltd, for infrastructure and toll projects. The company has secured notable contracts with Bharat Oman Refineries Ltd and Indian Oil Corporation for extensive civil and structural work across various pipeline and refinery projects.

In 2010, the company also diversified into the energy sector, marking a significant expansion into renewable energy by securing large-scale solar projects and establishing manufacturing facilities, including a 350,000 MTPA LSAW plant in Anjar, India, and an ERW plant in the United States. Welspun Enterprises is widely recognized for its work on the Delhi-Meerut Expressway project, underscoring its leadership in major infrastructure initiatives across India.

Industry Outlook

The Indian infrastructure sector is on a solid growth trajectory for FY25 and beyond, fueled by extensive government initiatives, increased private sector investments, and the demands of urbanization. Programs like PM Gati Shakti are catalyzing sector growth with ambitious projects, including the construction of 2 lakh km of national highways by 2025, along with expressways and urban infrastructure enhancements. The sector is anticipated to grow at a CAGR of 8-10% over the next five years, with highways projected to expand at over 10% annually. This growth extends to airports, ports, and railways, with high-impact projects such as the Delhi-Mumbai expressway and 12 new greenfield airports underway, boosting logistics efficiency and economic progress.

In line with this growth, Welspun Enterprises Ltd. (WEL) is advancing its “Growth & Green” strategy through the DGT Project, which focuses on the collection, treatment, and repurposing of wastewater from Dharavi for reuse—an initiative underscoring sustainability and water reuse. WEL’s board recently approved an additional 9.99% stake in Welspun Michigan (WMEL), bringing ownership to over 60%. This acquisition supports a collaboration with Smart-Ops Water UK to introduce SABRE technology—a cutting-edge wastewater treatment process aimed at addressing untreated sewage in India.

With a consolidated order book of ₹15,200 crores and a rich pipeline of projects, Welspun Enterprises is positioned to drive execution and create long-term value across its verticals, capitalizing on the expanding infrastructure opportunities in India.

Business Segments

Welspun Enterprises Ltd operates primarily through two key business segments, contributing significantly to its overall portfolio.

- Infrastructure: This segment focuses on the engineering, procurement, and construction (EPC) of infrastructure projects, particularly in roads, water supply, and urban development. The company engages in both Build-Operate-Transfer (BOT) and traditional EPC contracts. Some notable projects include the construction of major highways, rural water supply projects under the Jal Jeevan Mission, and various urban infrastructure initiatives. The infrastructure segment has seen robust growth, with sales reaching on TTM basis approx. to ₹32.27 billion in Q2FY25. This segmentation has further diversifications such as water treatment, tunnelling, road constructions, etc.

- Oil and Gas: In addition to infrastructure, Welspun Enterprises is involved in oil and gas exploration activities. This includes participation in the upstream oil and gas sector through a joint venture with Adani, focusing on a gas-based economy. The company also undertakes water transmission and distribution, alongside water and wastewater treatment services.

The strategic focus of Welspun Enterprises on sustainable infrastructure development positions it well within India’s growing market, especially with government initiatives aimed at enhancing infrastructure across the nation. The company is actively participating in projects that address critical areas such as water management and urban development, which are pivotal for future growth.

Key Subsidiaries and Their Information

Welspun Enterprises has several key subsidiaries that enhance its infrastructure portfolio. It also operates through various Associates and Joint Ventures.

- Welspun Projects (Himmatnagar Bypass) Private Limited focuses on road infrastructure development, specifically the construction and management of bypasses to improve traffic flow.

- Welspun Projects (Kim Mandvi Corridor) Private Limited is dedicated to developing vital highway corridors that enhance regional logistics.

- Dewas Water projects Works Private Limited specializes in sustainable water supply infrastructure for urban areas, while

- Welspun Buildtech Private Limited is involved in the construction of residential and commercial buildings.

- Additionally, ARSS Bus Terminal Private Limited focuses on transportation infrastructure by developing bus terminals to improve public transport services.

- Grenoble Infrastructure Private Limited supports a wide range of urban and rural development projects.

- DME Infra Private Limited works on diverse infrastructure projects across various sectors.

- Welspun Sattanathapuram Nagapattinam Road Private Limited handles critical roadway construction and maintenance.

- Welspun Aunta-Simaria Project Private Limited is engaged in project management, ensuring timely completion and quality oversight of construction projects.

- Welsteel Enterprises Private Limited supplies steel products and services for construction needs.

- Welspun – Kaveri Infraprojects JV collaborates on large-scale infrastructure initiatives.

- Welspun EDAC JV Private Limited is involved in significant joint venture infrastructure projects, combining expertise from partners.

- Welspun Michigan Engineers Limited provides engineering services and contributes to various construction projects, solidifying Welspun Enterprises’ capability to address multiple segments of the infrastructure market.

Q2 FY25 Highlights

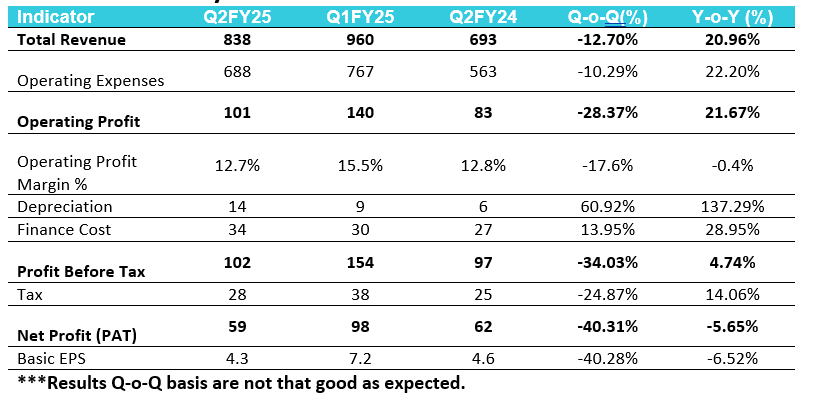

- Revenue from operations surged by 22.1%, reaching ₹788.5 crore, compared to ₹645.7 crore in the same quarter last year. Total income increased to ₹837.92 crore from ₹692.65 crore year-over-year, while expenses rose to ₹736.33 crore from ₹595.61 crore. Highest-ever H1 Income of ₹ 1,798 Crores achieved in period ending September 2024.

- The company’s EBITDA grew by 21.7%, totaling ₹100.5 crore, up from ₹82.6 crore in the previous year. However, the EBITDA margin slightly decreased to 12.7%, down from 12.8% year-on-year.

- Consolidated net profit for the September quarter of FY25 fell by approximately 11% to ₹61.56 crore, primarily due to higher expenses. Abhishek Chaudhary has been appointed as the new Chief Executive Officer (CEO), effective November 4, 2024.

- The consolidated order book of the company stood at ₹15,200 crore at the end of September 2024.

- The board approved the acquisition of an additional 9.99% stake in Welspun Michigan from Patel Engineering for around ₹100 crore.

- Welspun Enterprises secured a significant design and build contract worth ₹1,989 crore from the Brihanmumbai Municipal Corporation (BMC). This contract involves designing and constructing a tertiary treated water conveyance tunnel from the Dharavi Wastewater Treatment Facility to the Ghatkopar WWTF.

Financial Summary

SWOT Analysis

Strengths:

- Diverse portfolio of projects.

- Strong financial backing.

- Proven expertise in infrastructure development.

- Robust order book with ongoing contracts.

Weaknesses:

- High capital expenditure leading to increased debt.

- Dependence on government contracts for revenue.

- Limited international presence.

- Risk of project delays.

Opportunities:

- Growing infrastructure sector in India.

- Potential for public-private partnerships (PPP).

- Expansion into renewable energy projects.

- Adoption of technological advancements in project execution.

Threats:

- Intense competition in the infrastructure space.

- Challenges related to regulatory and environmental compliance.

- Rising input costs affecting profitability.

- Economic slowdowns impacting project viability.