Dabur Q2 Results: 17.5% YoY Drop in Net Profit to ₹425 Cr, Announces ₹2.75 Interim Dividend

Company Overview

Dabur India Ltd. is a prominent Indian consumer goods company with a strong portfolio in the fast-moving consumer goods (FMCG) sector, particularly in health, wellness, and personal care products. Established in 1884, Dabur has become a trusted household name and is recognized for its Ayurvedic and natural product offerings, catering to a broad spectrum of customer needs across India and over 100 international markets. Ayurveda-based healthcare is Dabur’s core strength. The brand’s portfolio includes products such as Dabur Chyawanprash, Dabur Honey, Dabur Honitus, and Dabur Lal Tail, which are deeply rooted in Ayurvedic formulations. The company has acquired 51% stake in Badshah Masala.

Industry Outlook

The FMCG sector has witnessed a significant shift toward health, wellness, and immunity-boosting products, accelerated by the COVID-19 pandemic. Consumers are increasingly seeking products with natural ingredients and Ayurvedic formulations for both preventive and curative healthcare. The FMCG sector in India is benefiting from expanding consumer spending in both urban and rural areas. Rising disposable incomes, population growth, and increasing awareness of branded, quality products have fuelled FMCG demand. The demand for personal care items free of chemicals, synthetic ingredients, and additives is expected to grow, allowing Dabur to expand its market share in segments such as oral care, skin care, and hair care.

Business Segments

- Health Care: It includes many product categories in its portfolio like Dabur Chyawanprash, Honey, Pudin Hara, Dabur Lal Tail, etc. which is huge brands in India and they all are used for consumers’ health benefits and healthy routines. This segment is a core business contributes about 31-35% of Dabur’s revenue.

- Personal Care: It is used by many consumers as daily routine for their personal care, the products like Dabur Amla, Dabur Red Paste, and Vatika. And there are other international brands of Dabur which has presence outside India for personal care, oral care, skin or hair care, etc.

- Food & Beverages: This segment includes a very popular packaged soft drink brand called Real, its yearly turnover is more than ₹1000 crore. And the Badshah Masala brand, which is a huge private company is acquired 51% stake for ₹590 crore.

- Geography: The international business accounts for almost 25% revenue of the company. The geography distribution of International market is Middle East- 24%, Africa- 24%, Europe- 15%, America- 15% and Asia-22%.

Quarterly Highlights

- Revenue of ₹3029 crore in Q2 FY25 down by 6.54% YoY from ₹3204 crore in Q2 FY24.

- EBITDA of ₹553 crore in this quarter at a margin of 18% compared to 21% in Q2 FY24.

- Profit of ₹418 crore in this quarter compared to a ₹507 crore in Q2 FY24.

Business Highlights

- The heavy monsoon and flooding impacted the beverage category in this quarter, but edible oils and ghee have grown by 70% and the Badshah has continued its growth with the gains in market share.

- UAE and Egypt saw a strong double digit growth, so Dabur is investing in capacity expansion to service increased demand.

- Winter season is great for the company as its many products are related and beneficial to use in this particular season like Chyawanprash products, Honey, Oils, etc. which will increase their quarterly revenue.

- Dabur has merged Sesa Care Private Ltd with annual turnover of ₹133 crore, which can help Dabur premiumize the Ayurvedic portfolio to attract higher margins.

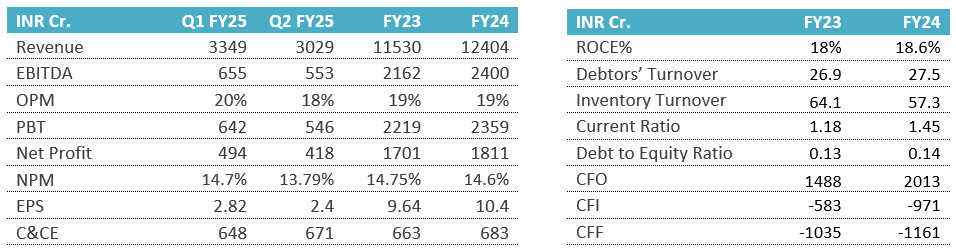

Financial Summary and Key Ratios

SWOT Analysis

Strengths:

- Established brand with a strong legacy

- Diverse and comprehensive product portfolio

- Extensive and well-established distribution network

Weaknesses:

- Limited presence in developed markets

- Fluctuating raw material costs

- Exposure to regulatory risks

Opportunities:

- Growth potential in Tier 2 and Tier 3 markets

- Opportunities for product innovation and premium offerings

- Expansion into international markets

- Rising demand for Ayurvedic and natural products

Threats:

- Intense competition in the industry

- Risk of counterfeit or imitation products

- Vulnerability to economic downturns