Petronet LNG Limited: Regulatory Challenges and Clean Energy Transition

Petronet LNG Limited: Overview

In 1998, Petronet LNG Ltd. was established to oversee the planning, building, and operation of LNG import and regasification terminals, hence playing a crucial role in India’s energy sector. GAIL, Indian Oil Corporation (IOCL), Bharat Petroleum (BPCL), and ONGC formed the joint venture, each with an equal 12.5% share. It runs two main terminals, one in Dahej, Gujarat, with a capacity of 17.5 MMTPA and another in Kochi, Kerala, with a capacity of 5 MMTPA, for a total of 22.5 MMTPA. The majority of its revenue, around 95%-96%, comes from LNG sales, with the remaining 3%-4% from regasification services. GAIL, IOCL, and BPCL are key customers, accounting for about 95% of total revenue. Petronet is building a new LNG terminal at Odisha, with an initial capacity of 4 MMTPA and an estimated investment of ₹2,300 crore, as part of its infrastructure expansion to further solidify its position. The corporation is also increasing the storage and regasification capacities of its existing terminals. Furthermore, Petronet is expanding into the Green Hydrogen value chain, demonstrating its commitment to innovation, sustainability, and alignment with global clean energy trends.

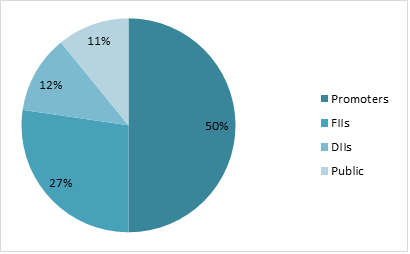

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹49190 Crore |

| Revenue | ₹54977 Crore |

| Profit | ₹3917 Crore |

| ROCE | 26.41% |

| P/E | 12.56 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Petronet LNG | 49190 | 54977 | 3917 | 26.41% | 2.22 | 6.67 | 0.15 | 12.56 |

| GAIL | 125577 | 136080 | 11534 | 14.66% | 1.15 | 7.25 | 0.23 | 10.89 |

| Adani Total Gas | 80845 | 4687 | 702 | 21.2% | 0.73 | 66.3 | 0.37 | 115.3 |

| Gujarat Gas | 34970 | 16295 | 1225 | 20.51% | 1.39 | 15.36 | 0.02 | 28.55 |

| Mahanagar Gas | 12802 | 6437 | 1149 | 36.6 | 0.94 | 6.85 | 0.03 | 11.14 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 35452 | 26023 | 43169 | 59899 | 52729 |

| Expenses | 31462 | 21323 | 37918 | 55045 | 47520 |

| EBITDA | 3990 | 4700 | 5250 | 4854 | 5209 |

| OPM | 11% | 18% | 12% | 8% | 10% |

| Other Income | 306 | 377 | 395 | 523 | 605 |

| Net Profit | 2703 | 2939 | 3438 | 3326 | 3652 |

| NPM | 7.6% | 11.3% | 8.0% | 5.6% | 6.9% |

| EPS | 18.02 | 19.59 | 22.92 | 22.17 | 24.35 |

Stock Price Analysis

The stock has not given any return in phase of 2017 to 2023, it was in consolidation and broke it and now it is trading at around its high level of ₹340 per share. The volume of shares traded has lowered these days compared to years in history. The stock might fall a little on basis of technical analysis for couple of months.

Latest Stock News (2 January 2025)

Petronet LNG Ltd. clarified that LNG terminal regulation does not fall under the PNGRB’s purview without amendments to the 2006 Act. The company highlighted its competitive regas charges, which constitute only 5-6% of delivered gas prices.

However, PNGRB’s recent paper criticized rising regas charges despite capacity expansion at the Dahej terminal, suggesting the need for regulatory oversight to ensure fair pricing. Foreign brokerage Citi flagged regulatory risks, issuing a “Sell” rating with a ₹310 target. Petronet shares dropped 5.49% to ₹328.50, signaling a negative start to 2025 after a 45% gain in 2024.