CRISIL Upgrades Suzlon Energy Ltd Ratings, ITAT Cancels ₹87.59 Crore Penalty

Suzlon Energy Limited: Overview

Suzlon is a leading global provider of renewable energy solutions and a vertically integrated manufacturer of wind turbine generators (WTGs). The company’s operations span the design, development, and manufacturing of key components, including rotor blades, tubular towers, generators, control systems, gears, and nacelles. Additionally, Suzlon offers operation and maintenance (O&M) services in both India and international markets. As a comprehensive renewable energy solutions provider, Suzlon is involved in manufacturing, project execution, and O&M of wind turbine generators, along with the sale of related components. With over 20 GW of wind energy installations across 17 countries and 111+ wind farms in India boasting a total capacity of 13,880 MW, the company has a strong global footprint. Revenue contributions include ~73% from the sale of wind turbines and components, and ~27% from O&M services.

Latest Stock News (3 January 2025)

CRISIL has upgraded Suzlon energy Ltd rating for loan of ₹3050 crores, long term rating A and short term rating of A1. It was the second time, CRISIL has updated the ratings. Income Tax Appellate Tribunal (ITAT) has decided the quantum appeal in favour of the company and JAO has cancelled the penalty order of ₹87.59 crore. In total the total penalty amount levied by National Faceless Penalty Centre, Income Tax Department is ₹260.3 crores. The CEO of SE Forge Ltd a wholly owned subsidiary of the Company has resigned from the position.

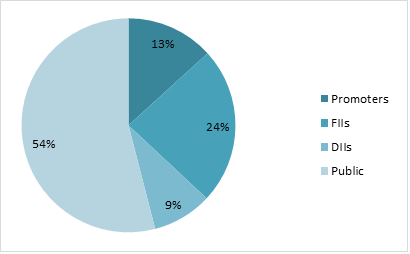

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹83849 Crore |

| Revenue | ₹7881 Crore |

| Profit | ₹986 Crore |

| ROCE | 24.93% |

| P/E | 85 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Suzlon Energy | 83849 | 7881 | 986 | 24.93% | 1.03 | 62.65 | 0.06 | 85 |

| CG Power & Ind. | 112609 | 8810 | 896 | 46.63% | 1.56 | 85.9 | 0.01 | 125.6 |

| Hitachi Energy | 64105 | 5850 | 199 | 17.85% | 1.21 | 155.6 | 0.25 | 321.4 |

| Premier Energies | 59750 | 3143 | 231 | 25.3% | 1.11 | 116.8 | 0.55 | 254 |

| Triveni Turbines | 24755 | 1854 | 315 | 38.5% | 1.09 | 53.6 | 0.01 | 78.4 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 2973 | 3346 | 6582 | 5971 | 6529 |

| Expenses | 3829 | 2809 | 5682 | 5137 | 5492 |

| EBITDA | -856 | 537 | 900 | 833 | 1037 |

| OPM | -29% | 16% | 14% | 14% | 16% |

| Other Income | -42 | 823 | 95 | 2739 | -26 |

| Net Profit | -2692 | 104 | -177 | 2887 | 660 |

| NPM | -90.5% | 3.1% | -2.7% | 48.4% | 10.1% |

| EPS | -4.01 | 0.1 | -0.17 | 2.28 | 0.49 |

Stock Price Analysis

In terms of performance, Suzlon Energy has shown a return of -5.27% over the past month, and -18.2% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹35.49 and a high of ₹86.04. The trades’ volumes have increased greatly and stock has also increased significantly indicating high volatility. The stock price now is at resistance level and might see some setbacks in coming weeks.