IDBI Bank Ltd: Driving Growth and Stability in India’s Banking Sector

IDBI Bank Ltd: Overview

IDBI Bank Ltd., a prominent player in the Indian banking sector, operates as a full-service bank offering a wide range of financial products and services to retail, corporate, and small business clients. Originally established in 1964 as the Industrial Development Bank of India, it was created to support India’s industrial growth. Over the years, it transitioned into a commercial bank while retaining its developmental focus. The bank’s offerings include savings and current accounts, loans, investment products, and payment solutions, alongside specialized services like project financing and treasury operations. Now majority-owned by Life Insurance Corporation of India (LIC), IDBI Bank benefits from the backing of one of the country’s largest financial institutions, which bolsters its financial stability and brand value. With a network of branches and ATMs spread across the nation, IDBI Bank aims to serve diverse customer segments effectively, supported by digital initiatives to enhance convenience and accessibility. The Indian banking industry is poised for steady growth, driven by economic expansion, increasing digital adoption, and a rising demand for financial inclusion. The sector is seeing a significant push toward modernization, with banks focusing on technology to streamline operations and improve customer experiences. However, challenges like rising competition, non-performing assets (NPAs), and regulatory pressures remain concerns. Within this dynamic environment, IDBI Bank is strategically positioned to leverage its strong parentage, operational expertise, and evolving digital capabilities to capture emerging opportunities. Its focus on improving asset quality and expanding its retail and MSME portfolios aligns with the broader industry trend of risk management and growth diversification.

Latest Stock News

Asset quality for IDBI Bank remained stable on a sequential basis, with gross non-performing assets (NPA) at 3.57% compared to 3.68% in the previous year. Net NPA for the quarter stood at 0.18%, showing a slight improvement from 0.2% in the preceding quarter. In another key development, the bank’s board approved the sale of its entire holding of 8.54 lakh shares, valued at ₹100 each, in Pondicherry Industrial Promotion Development and Investment Corporation Ltd. (PIPDIC), which represents a 21.14% stake in the associate company.

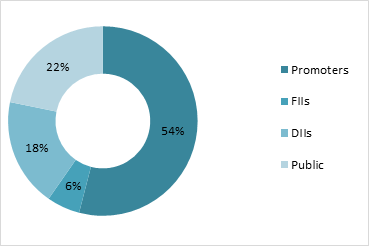

The disinvestment process for IDBI Bank is gaining traction, with financial bids for a 60.72% stake expected to be invited by the end of the current fiscal year, according to government sources. This stake sale, which includes 30.48% held by the government and 30.24% by LIC, will involve transferring management control as part of the strategic sale. The process is one of the largest disinvestment efforts in the banking sector. Before proceeding, the Reserve Bank of India (RBI) conducted a “fit and proper” assessment of the bidders, ensuring compliance with regulatory norms.

Following RBI clearance, the government opened a data room in November to allow bidders access to IDBI Bank’s legal and financial documents. This move facilitates a thorough due diligence process, enabling bidders to evaluate the bank’s performance and request additional information as needed. With these preparations in progress, financial bids are anticipated to finalize the future ownership structure of IDBI Bank by March 2025, marking a significant milestone in its strategic sale.

Q3 FY24 Earnings

- Revenue of ₹7819 crore in Q3 FY25 up by 19.4% YoY from ₹6549 crore in Q3 FY24.

- EBITDA of ₹1854 crore in this quarter at a margin of 24% compared to 15% in Q3 FY24.

- Profit of ₹1954 crore in this quarter compared to a ₹1515 crore profit in Q3 FY24.