Aegis Logistics Ltd: Accelerating Growth in India’s Liquid and Gas Logistics with 25% CAGR

Aegis Logistics Limited: Overview

Aegis Logistics Ltd. is a leading integrated logistics company in India, specializing in the handling and storage of liquid, gas, and chemical products. Established in 1956, the company operates through two key business segments: Liquid Terminal Division and Gas Terminal Division. These divisions provide end-to-end supply chain solutions for its clients, including storage, distribution, and terminal services. It has two business segments Liquid and Gas Terminal Division, where it provides services such as gas bottling, bulk LPG distribution, and retail operations through partnerships with oil marketing companies. Aegis Logistics has built a robust infrastructure, including state-of-the-art terminals, pipelines, and distribution facilities. The company has leveraged its strategic locations near major consumption centers to cater to the needs of large industrial and retail clients.

Latest Stock News (9 Jan 2025)

Aegis Logistics’ share price also rallied driven by recent government directives aimed at strengthening the natural gas sector. On 31 December 2024, a circular was issued by the Ministry of Petroleum and Natural Gas. The circular mandates key changes that directly benefit city gas distribution (CGD) companies, indirectly influencing investor sentiment toward the stock. The GAIL India cannot reduce natural gas allocations to CGD companies without prior approval from the Ministry of Petroleum and Natural Gas. The company is targeting a 25% compound annual growth rate (CAGR) by FY27. With approximately half of its Rs 45 billion (bn) capital expenditure program already completed or underway, it’s on track to meet its growth objectives.

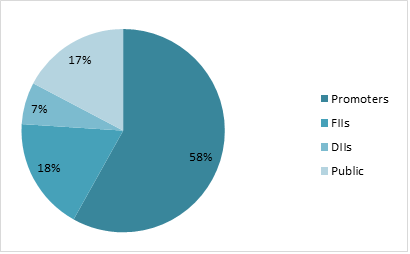

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹29133 Crore |

| Revenue | ₹7062 Crore |

| Profit | ₹583 Crore |

| ROCE | 14.7% |

| P/E | 49.9 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Aegis Logistics | 29133 | 7062 | 583 | 14.7% | 0.94 | 26.47 | 1.06 | 49.9 |

| Adani Total Gas | 74925 | 4687 | 702 | 21.2% | 0.73 | 61.5 | 0.37 | 106.7 |

| Gujarat Gas | 33459 | 16295 | 1225 | 20.5% | 1.39 | 14.6 | 0.02 | 27.3 |

| Petronet LNG | 48052 | 54977 | 3917 | 26.4% | 2.22 | 6.5 | 0.15 | 12.3 |

| GAIL | 118075 | 136080 | 11534 | 14.6% | 1.15 | 6.87 | 0.23 | 10.2 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 7183 | 3843 | 4631 | 8627 | 7046 |

| Expenses | 6906 | 3456 | 4096 | 7955 | 6123 |

| EBITDA | 277 | 388 | 535 | 672 | 923 |

| OPM | 4% | 10% | 12% | 8% | 13% |

| Other Income | 33 | 37 | 39 | 187 | 190 |

| Net Profit | 134 | 249 | 385 | 511 | 672 |

| NPM | 1.87% | 6% | 8% | 6% | 10% |

| EPS | 2.93 | 6.36 | 10.19 | 13.2 | 16.22 |

Stock Price Analysis

In terms of performance, Aegis Logistics has shown a return of -6.48% in one day, 5.81% over the past month, and 20.07% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹354.15 and a high of ₹1035.7. Stock has given CAGR of over 30% for 10 years and the volatility is high right now, and stock has also fallen from its all-time high.