Dixon Technologies: Leading India’s EMS Revolution

Dixon Technologies (India) Limited: Overview

Established in 1993, is a leading Electronics Manufacturing Services (EMS) provider in India, operating across segments like consumer electronics, lighting, home appliances, CCTVs, mobile phones, and reverse logistics. It also produces security surveillance equipment, wearable, audible, and AC-PCBs. The company recently formed a joint venture with Imagine Marketing Pvt Ltd. for wireless audio solutions. As one of India’s largest LED TV manufacturers, Dixon caters to over 35% of the country’s demand and is a leading ODM player in lighting with extensive capacity across SKUs. It has the largest semi-automatic washing machine portfolio with models ranging from 6 kg to 14 kg. Headquartered in Noida, Dixon has 22 manufacturing facilities across India. It plans a capital expenditure of ₹300-400 crore annually over the next two years, alongside debt repayment obligations of ₹90-110 crore per year. Notable achievements include manufacturing 11 million smartphones, 26 million feature phones, and rolling out India’s first ODM-based Google TV solutions.

Lasted Stock News (9 Jan 2025)

There was a fall in stocks of Dixon, Kaynes tech, PG Electroplast and CG Power. The reason was that Tata Group is investing about $18 billion in the field of electronics and semiconductors and will open nine new factories in next two years. There is still ₹41,000 crore worth unpledged subsidies of government remains unallocated because some companies did not meet production levels.

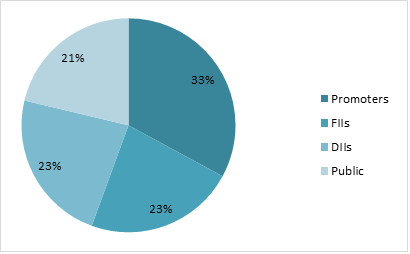

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹101573 Crore |

| Revenue | ₹27590 Crore |

| Profit | ₹561 Crore |

| ROCE | 9.16% |

| P/E | 180 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Dixon Tech | 101573 | 27590 | 561 | 29.2% | 3.03 | 94.6 | 0.35 | 180 |

| Kaynes Tech | 44613 | 1474 | 187 | 11.2% | 0.58 | 131 | 0.18 | 240 |

| PG Electroplast | 26893 | 3600 | 192 | 12.6% | 1.44 | 75 | 0.4 | 140 |

| CG Power | 106138 | 8810 | 896 | 46.6% | 1.56 | 80.7 | 0.01 | 119 |

| Genus Power | 11783 | 1581 | 146 | 11.34% | 0.54 | 37 | 0.7 | 80.1 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 4400 | 6448 | 10697 | 12192 | 17691 |

| Expenses | 4172 | 6156 | 10313 | 11673 | 16986 |

| EBITDA | 228 | 292 | 384 | 519 | 705 |

| OPM | 5% | 5% | 4% | 4% | 4% |

| Other Income | 5 | 1 | 4 | 4 | 32 |

| Net Profit | 120 | 160 | 190 | 255 | 375 |

| NPM | 2.7% | 2.5% | 1.8% | 2.1% | 2.1% |

| EPS | 20.8 | 27.6 | 32.05 | 42.9 | 61.5 |

Stock Price Analysis

In terms of performance, Dixon Technologies (India) has shown a return of -8.36% in one day, -2.47% over the past month, and 16.42% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹5785 and a high of ₹19149.8. Dixon has seen a huge rally over several years increasing interest from investors and the expanding industry has benefited the company stock price to grow further. The trading volumes are high and stock is one of trending stocks in recent times.