Tata Technologies Limited: Driving Innovation in Engineering and Digital Services

Tata Technologies Limited: Overview

Tata Technologies is a leading global engineering and product development digital services company, specializing in providing end-to-end solutions for the automotive, aerospace, industrial machinery, and other manufacturing sectors. Founded in 1989 and headquartered in Pune, India, the company delivers services in product engineering, manufacturing engineering, and IT solutions, helping clients enhance product innovation, reduce time-to-market, and optimize costs. Tata Technologies leverages advanced technologies such as AI, IoT, and Industry 4.0 to support its clients in achieving digital transformation. With a global footprint and a focus on sustainable solutions, the company plays a pivotal role in driving innovation across the industrial landscape. The total employee headcount is 12680 employees as of Q2 FY25. The automotive segment contributes about 85% to the revenues. Tata Technologies has done Joint Venture with BMW Group.

Latest Stock News (10 Jan 2025)

Tata Technologies Ltd. has signed a strategic memorandum of understanding MoU with Telechips to innovate vehicle software solutions for next generation software defined vehicles. Telechips is a global fabless semiconductor supplier, which provides SoC and MCU for the automotive industry and leads the system semiconductor market with its advanced products and technologies in the field of connectivity and multimedia semiconductors Jang-Kyu Lee, CEO of Telechips, stated: Our partnership with Tata Technologies highlights our commitment to transforming the automotive semiconductor landscape. By combining our advanced semiconductor solutions with their expertise in vehicle software and hardware integration, we are paving the way for safer, smarter, and more connected mobility solutions, enabling OEMs to lead in the SDV era.

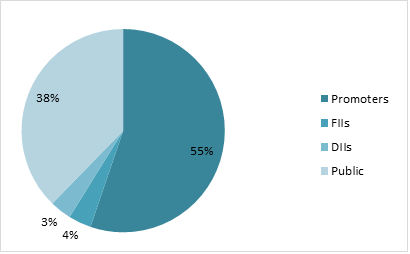

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹34025 Crore |

| Revenue | ₹5156 Crore |

| Profit | ₹657 Crore |

| ROCE | 28.3% |

| P/E | 52.6 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Tata Techno. | 34025 | 5156 | 657 | 28.3% | 0.95 | 32.27 | 0.08 | 52.6 |

| Coforge | 63020 | 10144 | 788 | 28.6% | 1.57 | 39.3 | 0.18 | 79.9 |

| KPIT Tech | 38297 | 5410 | 726 | 38.6% | 1.31 | 30.07 | 0.14 | 52.8 |

| Oracle Fin. | 100546 | 6881 | 2495 | 39.5% | 0.68 | 27.14 | 0.00 | 40.3 |

| Tata Elxsi | 37551 | 3726 | 809 | 42.7% | 1.19 | 30.46 | 0.08 | 46.4 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 2825 | 2381 | 3530 | 4414 | 5117 |

| Expenses | 2382 | 1995 | 2884 | 3593 | 4176 |

| EBITDA | 470 | 386 | 646 | 821 | 941 |

| OPM | 16% | 16% | 18% | 19% | 18% |

| Other Income | 36 | 39 | 49 | 88 | 116 |

| Net Profit | 252 | 239 | 437 | 624 | 679 |

| NPM | 8.92% | 10% | 12% | 14% | 13% |

| EPS | – | – | – | 15.38 | 16.75 |

Stock Price Analysis

In terms of performance, Tata Technologies has shown a return of -4.24% in one day, -11.15% over the past month, and -21.26% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹870 and a high of ₹1200. The price of stock has fell from the IPO listing price and has never reach at that levels. The stock is trading at all-time lows.