BHEL Limited: India’s Engineering Giant and Its Latest Achievements

BHEL Limited: Overview

Bharat Heavy Electricals Limited (BHEL) is one of India’s largest engineering and manufacturing companies in the energy and infrastructure sectors. Established in 1964, BHEL is a central public sector enterprise under the Ministry of Heavy Industries. It plays a pivotal role in India’s industrial and economic development, contributing to power generation, transmission, transportation, and renewable energy. HEL specializes in designing, engineering, manufacturing, and servicing a wide range of products and systems for power plants, industrial equipment, and transportation. The company has a vast product portfolio, including boilers, turbines, generators, and transmission systems, alongside providing services such as project management and construction. BHEL has done projects in over 80 countries, shows the strong footprint of BHEL.

Latest Stock News (13 Jan 2025)

Bharat Heavy Electricals Limited (BHEL) has achieved yet another milestone in Bhutan with the successful commissioning of two units of the 6×170 MW Punatsangchhu-II Hydroelectric Project (PHEP-II). Executed as part of a bilateral agreement between the Government of India and the Royal Government of Bhutan, PHEP-II is a Greenfield hydro project located in the Wangdue district of Western Bhutan. Bharat Heavy Electricals Limited (BHEL) and Oil & Natural Gas Corporation Ltd. (ONGC) have signed a MoU for exploring joint projects and collaboration in the area of New and Renewable Energy business. This MoU will help in contributing towards the country’s National Green Hydrogen Mission, as well as leveraging the combined strengths of both organisations for collaborating in emerging areas within the clean energy ecosystem.

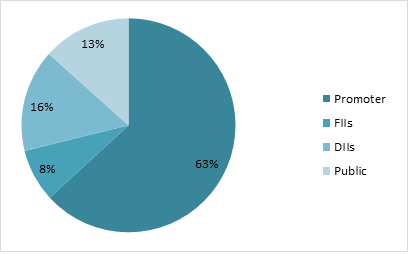

Shareholding Pattern as on September 2024

Key Stats

- Market Capitalisation: ₹67604 Crore

- P/E: 152

- ROCE: 3.4%

- ROE: 1.1%

- Dividend Yield: 0.12%

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| BHEL Ltd | 67604 | 25833 | 444 | 3.37% | 0.41 | 45.4 | 0.38 | 152 |

| Siemens | 208588 | 22239 | 2716 | 25.6% | 0.93 | 49.5 | 0.02 | 76.8 |

| ABB Ltd | 130267 | 11580 | 1688 | 30.7% | 1.03 | 52.1 | 0.01 | 77.5 |

| Hitachi Energy | 53777 | 5850 | 199 | 17.8% | 1.21 | 130.6 | 0.25 | 270 |

| Premier Energies | 59630 | 3143 | 231 | 25.2% | 1.11 | 96.9 | 0.55 | 214.9 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 21463 | 17309 | 21211 | 23365 | 23893 |

| Expenses | 21596 | 20357 | 20383 | 22321 | 23182 |

| EBITDA | -133 | -3049 | 828 | 1044 | 711 |

| OPM | -1% | -18% | 4% | 4% | 3% |

| Other Income | 590 | 393 | 405 | 544 | 608 |

| Net Profit | -1468 | -2700 | 445 | 654 | 282 |

| NPM | -6.84% | -16% | 2% | 3% | 1% |

| EPS | -4.21 | -7.75 | 1.28 | 1.88 | 0.81 |

Stock Price Analysis

In terms of performance, Bharat Heavy Electricals has shown a return of -5.53% in one day, -23.88% over the past month, and -28.39% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹195.6 and a high of ₹335.4. The stock has been falling for past 6 months; it is because of the weak quarter. The volumes have also reduced and the stock might fall more as the overall market is negative.