Max Healthcare Institute Ltd.: Comprehensive Overview, Growth, and Expansion

Company Overview

Max Healthcare Institute Ltd. (MHIL) is one of India’s leading providers of healthcare services, known for its comprehensive and integrated approach to healthcare. Established in 2000 and headquartered in New Delhi, MHIL operates a network of hospitals and healthcare facilities that deliver world-class medical services. The company has a significant presence in North India and offers a wide range of services across multiple medical disciplines. MHIL operates 17 healthcare facilities, including tertiary and quaternary care hospitals, primary care clinics, and specialized centers. Its flagship hospitals include Max Super Speciality Hospitals in Saket, Patparganj, and Shalimar Bagh in Delhi-NCR. Max Healthcare aims to continue its leadership in the Indian healthcare sector by expanding its capacity, investing in cutting-edge technology, and enhancing its presence in underserved markets.

Return Summary

| YTD | 1 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year |

| 59.84% | 5.01% | 33.4% | 60.59% | 150.66% | 189.16% | – |

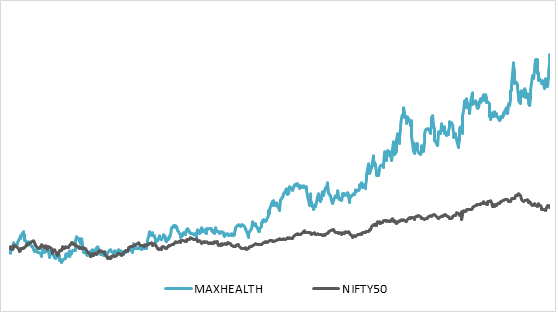

3 Year Return: MAXHEALTH v/s NIFTY50

Result & Business Highlights

- Revenue for YoY and QoQ is at increasing phase at Q2 FY25 revenue of ₹1707 crore with moderate EBITDA margin of 26% at ₹451 crore.

- Average Revenue per Occupied Bed (ARPOB) for Q2 was ₹76,100, with a growth of 7% for existing hospitals.

- Newly operational Max Dwarka hospital reported revenue of ₹33 crore, EBITDA loss of ₹18 crore, 41% occupancy, and ARPOB of ₹80,000; expected to break even before year-end.

- Acquisition of Jaypee Hospital, Noida, valued at ₹1,660 crore, anticipated to enhance presence in the National Capital Region; plans to increase operational bed capacity from 376 to 430 by March 2025.

- Ongoing expansions include 140 beds at Nagpur, 268 beds at Nanavati, 400 beds at Max Smart, 155 beds at Mohali, and 501 beds at Sector 56 Gurgaon, all on schedule.

- Max Home reported a revenue of ₹53 crore, a growth of 24% YoY, offering 14 specialized service lines across 12 cities.

- Max Lab generated gross revenue of ₹47 crore, reflecting a strong growth of 21% YoY, with over 1,100 collection centers

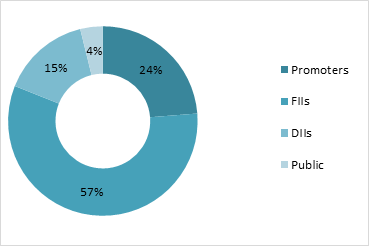

Shareholding Pattern

Return Comparison with Peers

| COMPANY | 1 Year | 2 year | 3 Year | 5 Year |

| Max Healthcare | 60.59% | 150.66% | 189.6% | – |

| Apollo Hospitals | 30.37% | 52.24% | 33.91% | 390.48% |

| Fortis Healthcare | 78.88% | 141.12% | 143.11% | 403.41% |

| Aster DM Healthcare | 20.4% | 111.31% | 151.8% | 212.8% |

| Narayana Hrudayalaya | 8.35% | 73.5% | 129.73% | 341.5% |

Contribution to Industry Size

Max Healthcare is one of the largest healthcare companies, contributed a lot to its industry and to India. The underpenetration of hospital beds and demand supply gap is reduced and the insurance penetration in healthcare sectors is rising from 32% in FY17 to 41% in FY24. The operations or any surgery procedure cost in India is approximately 70% – 90% discount to average global cost. The increasing use of latest technology in the treatment process has benefited the healthcare industry be efficient and useful in cost cutting also. The occupancy of Max Healthcare is approx. 75%, while others in industry are at average of 65%.

Balance Sheet Analysis

- Reserves have increased very significantly from FY21 with high revenues and efficient management operations to ₹7436 crore in FY24.

- Borrowing has increased year on year but in significant manner, makes no worry.

- The cash on balance sheet is enough to pay dividends regularly and carry on every day operations easily.

- The fixed assets has increased to ₹9506 crore, as company is investing a lot in expanding beds, medical equipments, land acquisitions for new hospital branches.

Cash Flow Analysis

- Cash flow from Operations is positive for many years and in FY24 it is ₹1122 crore.

- The Company has purchased fixed assets worth ₹786 crore in FY24, shows a great sign of expansion.

- Max Healthcare has now started paying dividends to its shareholders as it has now enough cash reserves.