Adani Power Stock Jumps 9% in Two Sessions – Is It the Right Time to Invest?

Business and Industry Overview:

Adani Power (APL) is the biggest private company that makes electricity in India. They have power plants in many states like Gujarat, Maharashtra, Karnataka, Rajasthan, Chhattisgarh, Madhya Pradesh, and Jharkhand. They also have a small solar power project in Gujarat. APL started making electricity in 2006 and was the first company to use special technology to make electricity from coal in a clean way. APL can make 15,250 MW of electricity. They have plants that use good technology to make power, and they can make electricity when people need it the most. They sell electricity to state companies and big businesses through long-term agreements. They also sell some electricity in the open market. APL is building new power plants to make even more electricity in the future. They want to increase their total power to 30,670 MW by 2032. In the last few years, they have faced some challenges, but they have used smart solutions to keep their business strong. They are spending a lot of money to improve their power plants and use new technology. APL cares about the environment and has received awards for their good work. They have a good score for taking care of the environment and being responsible. Recently, they won important legal cases that will help them get more money. APL is committed to growing while being good to the planet.

Thermal power is the biggest way India makes electricity. It gives about 71% of the power. Thermal power plants use fuels like coal, diesel, gas, and natural gas to create steam. This steam helps make electricity. As of August 2024, India can make 242.99 GW of power from these plants. Coal is very important. It makes up about 46.2% of all the power.

Some big power projects are in states like Jharkhand, Madhya Pradesh, Andhra Pradesh, Gujarat, Maharashtra, and Odisha. The thermal power sector is expected to grow because the government wants to make more coal and improve technology to reduce pollution. They plan to increase clean energy to 500,000 MW by 2031-32. They also want to grow renewable energy sources like wind and solar power.

India started using thermal power in 1920 with the first plant in Hyderabad. Today, most electricity comes from thermal, nuclear, and renewable sources. Coal is still the main source and makes up about 75% of all electricity. In December 2020, India made 103.66 billion units of power, according to the Central Electricity Authority.

Adani Power Limited is the largest private thermal power producer in India with an installed capacity of 15,250 MW.

Latest Stock News:

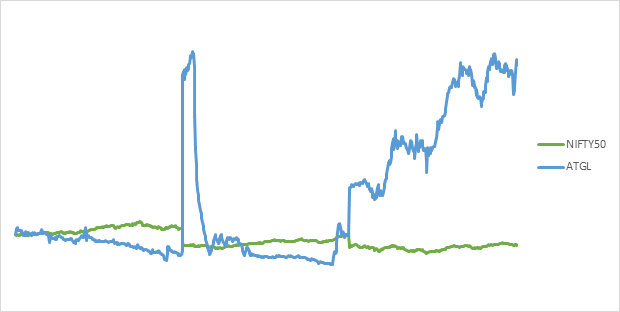

Adani Power’s stock price has gone up and down. In the last six months, it went down by 23%. In one year, it went down by 12%. But in two years, it went up by 260%. This week, the stock price went up by 9% in two days. On Thursday, it reached ₹512.30. Experts say if the price stays above ₹510, it may go up more, maybe to ₹589. Many people are buying the stock. The number of shares traded was 4 times more than usual. This is a good sign. The stock price went up after Adani Power got permission to buy Vidarbha Industries Power Ltd (VIPL). VIPL makes electricity and belongs to Reliance Power. VIPL has money problems, so Adani Power will take over. Adani Power has also bought three other power companies before this. Adani Group will also spend ₹1.1 trillion in Madhya Pradesh and ₹50,000 crore in Assam. They will build power plants, cement factories, mines, smart meters, roads, airports, and more.

Potentials:

Adani Power’s stock may go up by 30–54.5% in the future. The company is growing and making more electricity. It will increase its power capacity from 17.6 GW to 30.7 GW by 2030. It has land and money ready for this. Adani Power has long-term deals to sell electricity and buy fuel, which makes its business strong. More people in India are using gadgets, and factories need more power, so demand for electricity is increasing. Adani Power can help fill this gap. Experts say its profits will grow 10% every year from 2024 to 2027, and after 2027, when new power plants start working, profits may grow 19% every year. But there are some risks. It had old problems with power sale agreements, and sometimes payments get delayed. If demand is lower than expected, growth may slow down, but stock will yield a higher return.

Analyst Insights:

Market capitalisation: ₹ 1,87,428 Cr.

Current Price: ₹ 486

52-Week High/Low:₹ 897 / 431

P/E Ratio: 14.6

Dividend Yield:0.00 %

Return on Capital Employed (ROCE):32.2 %

Return on Equity (ROE): 57.1 %

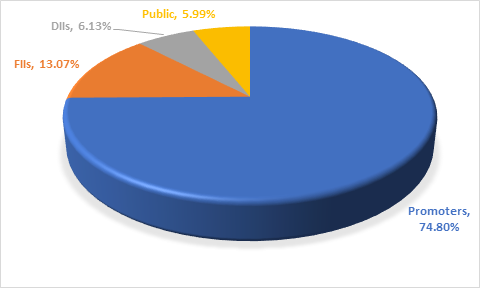

Adani Power is growing fast and making more money. In the last five years, its profit went up by 88.5% every year. It is good at using money and getting high returns. In the last three years, it had a return of 47.8%. The company is getting paid faster by customers, from 106 days to 84.6 days. Even though it makes a lot of profit, it does not give money to investors as dividends. In the last three months, its profit went up by 7.4% to ₹2,940.07 crore, and its total money earned grew by 5.2% to ₹13,671.18 crore. It made 8% more money before costs, and its profit margin got better, from 35.8% to 36.7%. It also sold 8% more electricity, reaching 23.3 billion units. The company plans to get ₹5,000 crore from investors and ₹11,000 crore through special loans. The CEO said the company wants to make over 30 GW of electricity by 2030. After sharing this good news, the stock price went up by 4.78% to ₹520.95.

Adani Power makes electricity. Its stock price is ₹486 now. Last year, the highest price was ₹897. The company is making good money and growing fast in the last five years. It is good at using money wisely. This year, the company made more money and more profit than last year. It is selling more electricity too. Adani Power wants to grow more. It will get more money from investors. It wants to make over 30 GW of electricity by 2030. The stock price went up after the good news. But the company does not give money to investors as dividends. It also has a lot of debt and is borrowing more money. This stock is good for people who want to invest for a long time and can take risks. But it is not good for people who want regular income.