Breakdown Stocks: How to Trade Asian Paints After Hitting a Fresh 52-Week Low?

Business and Industry Overview:

Asian Paints is the largest paint company in India. It makes and sells paints, coatings, and home décor products. The company started in 1942 in Mumbai. It grew quickly and became India’s top paint maker by 1967. Over the years, it expanded to other countries. It bought many paint companies to grow its business. Asian Paints also entered the home décor market. It sells kitchen and bathroom products. The company also provides interior design services. It even started selling decorative lighting. The founders’ families still own a big part of the company. Asian Paints continues to grow and reach more customers worldwide.

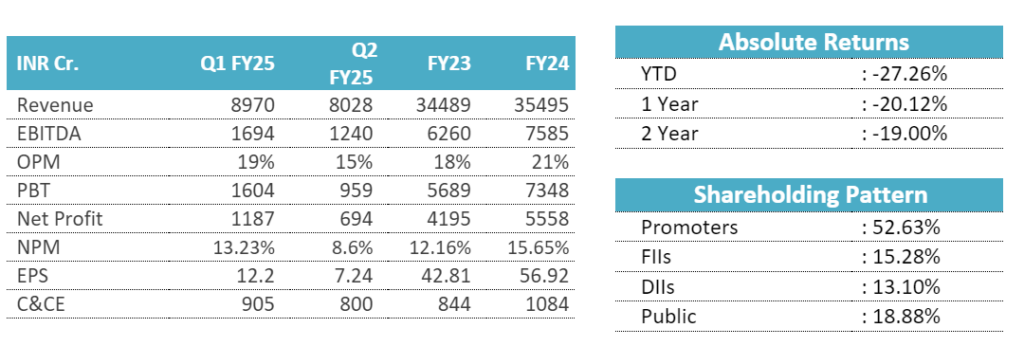

The Indian paint industry grew well in FY’22 and FY’23 but is now facing tough challenges. Competition has increased, and profit margins are under pressure. Established companies like Asian Paints, Berger Paints, and Kansai Nerolac saw revenue growth slow to 4% in FY’24, much lower than the 14-15% annual growth seen earlier. The slowdown happened because companies reduced prices due to lower raw material costs and more sales of lower-priced products.

In the first half of FY’25, revenue was further hit by tough competition, elections, and extended monsoon rains. New players like JSW Paints and Grasim Industries are expanding aggressively. They are adding new factories, more dealers, and larger sales teams. This has forced older companies to spend more on advertising and promotions, which is affecting their profits.

Operating margins, which were around 18% in past years, dropped to 16% in early FY’25. Experts expect margins to fall further to 14% by FY’26 because of pricing pressures. However, gross margins are expected to stay stable at around 40% due to recent price hikes of 1.5-2.5%. The share of organized players is likely to rise to 80% in the coming years as more factories open.

Decorative paints make up about 70-75% of total demand, driven by repainting, urbanization, and higher incomes. Industrial paints account for 25-30% of demand, supported by sectors like automobiles, oil and gas, and infrastructure. Despite challenges, the industry is expected to grow by 8-10% annually, though profits may be lower than before.

Latest Stock News:

Asian Paints’ stock fell to its lowest price in a year at ₹2,124.75 but later recovered, rising over 2% by noon. The drop happened after a well-known financial expert advised investors to avoid the stock due to uncertainty in demand. JPMorgan, a leading brokerage firm, has an “underweight” rating on the stock and set a target price of ₹2,300, expecting only a 5.5% increase.

The paint industry has been struggling, with most companies seeing slow sales growth in the last quarter. One new competitor, Birla Opus, has gained a mid-single-digit market share, increasing competition. Analysts say weak demand, trade de-stocking, and heavy discounts have hurt sales. However, they expect pricing to improve as previous price cuts settle.

Despite the slight recovery, many analysts remain cautious. Out of 40 analysts covering the stock, 19 recommend selling, 11 suggest holding, and only 10 have a buy rating. The stock has dropped 36% from its peak of ₹3,394. Experts suggest investors wait for clearer signs of demand growth before making a decision.

Potentials:

Asian Paints has outlined major expansion plans to strengthen its business and reduce costs. The company is setting up a large paint manufacturing plant in Madhya Pradesh with an investment of ₹2,000 crore. This facility will take about three years to become operational and will increase its production capacity.

To lower costs and reduce dependence on imports, Asian Paints is also investing ₹2,100 crore in manufacturing key raw materials used in paints. This move will improve profit margins and ensure a steady supply of materials.

Additionally, the company is expanding internationally by setting up a white cement plant in the UAE with an investment of ₹550 crore. This plant will support the production of putty and other related products.

Through these investments, Asian Paints aims to expand its market reach, improve efficiency, and remain competitive in the growing paint industry.

Analyst Insights:

- Market capitalisation: ₹ 2,07,666 Cr.

- Current Price: ₹ 2,165

- 52-Week High/Low: ₹ 3,395 / 2,125

- P/E Ratio: 47.6

- Dividend Yield: 1.54 %

- Return on Capital Employed (ROCE): 37.5 %

- Return on Equity (ROE): 31.4 %

Asian Paints is a strong company with consistent profit growth, a high return on equity (ROE) of 27.8% over three years, and a return on capital employed (ROCE) of 37.5%. It has been paying out 59.7% of its profits as dividends, making it attractive for long-term investors. However, the stock is expensive, trading at 11.5 times its book value, with a high P/E ratio of 47.6, suggesting it may not offer good returns at current levels. While the company has delivered a strong 20.5% CAGR profit growth over the last five years, the increasing competition and pricing pressures may impact future earnings. Existing investors should hold, but new investors should wait for a better entry price as the stock is currently overvalued.