Bajaj Holdings (BHIL) Q4 Results, Allianz Stake Acquisition, and 2025 Growth Strategy

Business and Industry Overview:

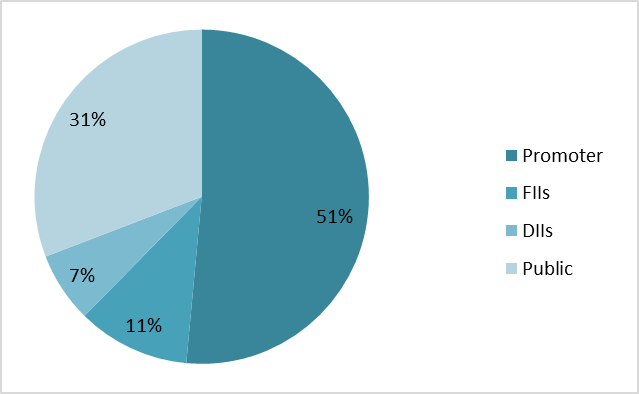

Bajaj Holdings & Investment Ltd (BHIL) is an Indian investment company. It started in 1945 and is part of the Bajaj Group. Earlier, it was called Bajaj Auto Ltd. On 18 December 2007, the Bombay High Court approved a demerger. After that, the manufacturing business went to a new company called Bajaj Auto Ltd (BAL). The wind energy and financial services business went to Bajaj Finserv Ltd (BFS). The rest of the assets, money, and duties stayed with BHIL. After this change, BHIL became an investment company. It now holds more than 30% shares in both BAL and BFS. BHIL earns money from dividends and by investing in shares, bonds, and mutual funds. BHIL is also a Non-Banking Financial Company (NBFC). It got its NBFC license from the Reserve Bank of India (RBI) on 29 October 2009. Its RBI registration number is N-13.01952. It is called a ‘Systemically Important Non-deposit taking NBFC’. BHIL can give money support to BAL and BFS but only on fair terms. BHIL will also grow if BAL and BFS grow. RBI does not take any responsibility for BHIL’s financial health. RBI also does not promise to repay any deposit money. BHIL does not keep any deposit with RBI. As of April 2025, BHIL’s share price was around ₹11,499.

Latest Stock News:

Bajaj Holdings & Investment Ltd (BHIL) gave some big news in March 2025. BHIL, Bajaj Finserv, and Jamnalal Sons will buy 26% shares from Allianz. These shares are in two insurance companies – Bajaj Allianz Life and Bajaj Allianz General. BHIL will buy 19.95%. Bajaj Finserv will buy 1.01%, and Jamnalal Sons will buy 5.04%. After this, the Bajaj Group will fully own both insurance companies. This may help Bajaj Group grow more in future. On April 1, 2025, BHIL’s share price went down by 3.25%. This was the third day in a row the price fell. In three days, the total fall was 4.06%. But on April 8, 2025, the share price went up a bit to ₹10,833. In the last quarter (October to December 2024), BHIL earned ₹158.23 crore but had a loss of about 46%. On March 31, 2025, BHIL said the trading window is closed. This means people inside the company cannot buy or sell shares. The window will open after the company gives its full-year results for March 2025. Investors are waiting for these results.

As of April 8, 2025, Bajaj Holdings & Investment Ltd (BHIL) is trading at ₹10,833.00, which is a small 1.01% rise from the previous price. On March 18, 2025, BHIL, Bajaj Finserv, and Jamnalal Sons made a big move. They agreed to buy Allianz’s 26% stake in two companies: Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance. BHIL will buy 19.95% of the shares. After this, the Bajaj Group will fully own both insurance companies. This could help the group grow more in the future. On March 31, 2025, BHIL said its trading window is closed. This means company insiders cannot buy or sell shares until the company releases its full-year results for March 2025. In the last quarter (ending December 31, 2024), BHIL earned ₹126.33 crore, which is 16.92% more than last year. The stock price has been going up and down. It has a 52-week high of ₹13,221.50 and a low of ₹7,667.15. Investors are waiting for the full-year results and to see how the Allianz deal will affect the company’s growth.

Potentials:

Bajaj Holdings & Investment Ltd. (BHIL) has big plans for the future. One key plan is the recent deal where Bajaj Finserv Ltd. announced it will buy Allianz SE’s entire 26% stake in Bajaj Allianz General Insurance Company Ltd (BAGIC) and Bajaj Allianz Life Insurance Company Ltd (BALIC). This deal is worth ₹24,180 crore and ends the 24-year partnership between Bajaj and Allianz. Bajaj Finserv will pay ₹13,780 crore for Allianz’s stake in BAGIC and ₹10,400 crore for its stake in BALIC. After this deal, Bajaj Group will own 100% of both insurance companies instead of the current 74%. The acquisition will be done by distributing the stake between the Bajaj Group companies. Bajaj Finserv will buy around 1.01% of each company, BHIL will acquire 19.95%, and Jamnalal Sons Pvt. Ltd. will get about 5.04%. After the deal, Bajaj Finserv’s stake in both companies will rise to 75.01%. The deal still needs approval from the Competition Commission of India (CCI) and the Insurance Regulatory and Development Authority of India (IRDAI). Sanjiv Bajaj, the chairman of Bajaj Finserv, believes that this move will help grow the business and bring more value to the group. This deal marks an important step in Bajaj Finserv’s strategy to provide new, technology-driven insurance solutions across India. After the deal, Allianz will focus on other growth opportunities in India and possibly enter as an independent operator if laws allow 100% foreign investment in the insurance sector. Both companies are working together to ensure the transition is smooth for customers and other stakeholders.

Analyst Insights:

- Market capitalisation: ₹ 1,20,526 Cr.

- Current Price: ₹ 10,833

- 52-Week High/Low: ₹ 13,238 / 7,660

- Stock P/E Ratio: 16.0

- Dividend Yield: 1.21%

- Return on Capital Employed (ROCE): 13.1%

- Return on Equity (ROE): 14.8%

Bajaj Holdings & Investment Ltd. (BHIL) is a good company to invest in. It has grown profits by 19% every year for the last 5 years, which shows it is making good money. The company has very little debt, which makes it less risky. BHIL has become better at using its money. It now takes less time to make profits, which is a good sign. The company pays a small dividend of 1.21%, so investors can get regular money from it. BHIL owns parts of two successful companies: Bajaj Auto Ltd. and Bajaj Finserv Ltd.. This helps BHIL grow as these companies grow. The stock price is not too high. The P/E ratio is 16.0, which is reasonable compared to other companies. However, there are some things to watch. BHIL’s return on equity is 12.2%, which is not very high. Also, a large part of its earnings come from other income (₹6,147 crore), which may not happen every year.

Overall, BHIL has strong profits, low debt, and a dividend. It can grow with Bajaj Auto and Bajaj Finserv. So, it’s a good buy.