Is Bharat Earth Movers Ltd. (BEML) the Next Big Investment Opportunity?

Company Overview

Bharat Earth Movers Ltd. (BEML), headquartered in Bengaluru, India, is a leading public sector undertaking under the Ministry of Defence. Established in 1964, BEML has evolved into a diversified engineering powerhouse, catering to critical sectors including defense, railways, and construction. The company plays a pivotal role in India’s infrastructure and defense development. BEML is a key supplier of military equipment to the Indian armed forces, producing high-mobility vehicles, tank transporters, and missile launchers. BEML offers a comprehensive range of heavy-duty machinery for mining and construction projects, including dump trucks, bulldozers, excavators, and loaders. BEML has a strong domestic footprint and is steadily expanding its international presence, with exports to over 68 countries.

Return Summary

| YTD | 1 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year |

| 57.82% | 9.05% | 10.47% | 82.19% | 190.46% | 129.85% | 353.97% |

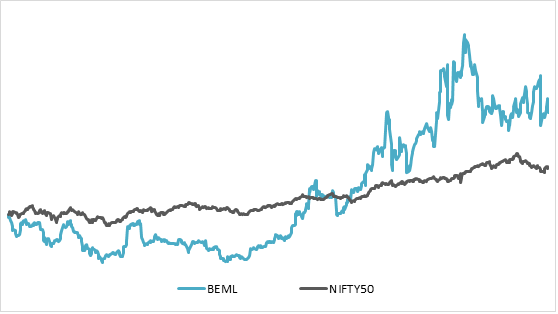

3 Year Return: BEML v/s NIFTY50

Result & Business Highlights

- Revenue for YoY and QoQ is at increasing phase at Q2 FY25 revenue of ₹860 crore with a moderate EBITDA margin of 8% at ₹73 crore.

- Business segments contribution is Defence & Aerospace 19%, Mining & Construction 43% and Rail & Metro 38%.

- BEML exports over 1400+ equipment to 72 countries; railway products are exported to the SAARC region.

- Export turnover in FY20 was ₹463 crores, which is now over ₹1066 crores in FY24 and is ₹196 crore in Sep 2024.

- Major accomplishment of BEML are 350 armoured vehicles, 3560 military wagons, 2000 metro cars and 18000 rail coaches.

- The company has won new contracts worth ₹136 crore and ₹83 crore from the Ministry of Defence.

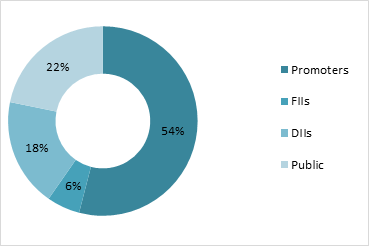

Shareholding Pattern

Return Comparison with Peers

| COMPANY | 1 Year | 2 year | 3 Year | 5 Year |

| BEML | 82.19% | 190.46% | 129.85% | 353.97% |

| Hindustan Aeronautics | 66.55% | 241.84% | 612.54% | 1123.19% |

| Bharat Dynamics | 78.41% | 156.77% | 501.51% | 750.86% |

| Paras Defence | 58.46% | 81.63% | 53.49% | – |

| MTAR Technologies | (23.53%) | 3.52% | (27.29%) | – |

Contribution to Industry Size

The Indian defence manufacturing sector is valued at approximately $12 billion, with a goal to reach $25 billion by 2025 under the government’s “Make in India” initiative. BEML is a critical supplier of high-mobility vehicles, tank transporters, missile launchers, and ground support equipment. The company supports over 40% of the market for high-mobility military vehicles, positioning it as a key enabler of indigenous defence manufacturing. The Indian mining and construction equipment market is valued at around ₹25,000 crore (~$3 billion), with steady growth driven by infrastructure investments. The Indian railways and metro rail systems are part of a $20 billion industry, with significant investments in urban transit expansion. It holds a dominant position in metro coach manufacturing, supplying vehicles for major cities like Delhi, Bengaluru, and Mumbai.

Balance Sheet Analysis

- Reserves are stable at ₹2038 crore from FY21 to ₹2650 crore with high revenues and efficient management operations to ₹4054 crore in FY24.

- Borrowing has reduced year on year, makes no worry.

- Trade receivables are increasing makes a worry for company in collection of income form government.

Cash Flow Analysis

- Cash flow from Operations is ₹560 crores in FY23 and ₹458 crores in FY24.

- The Company has purchased fixed assets worth ₹101 crore in FY24, shows a great sign of expansion.

- Company is paying dividends continuously every year to its shareholders, shows a positive sign of stable company.