Dixon Technologies Q3 Earnings: Pioneering India’s Electronics Manufacturing Revolution

Dixon Technologies Ltd: Overview

Dixon Technologies (India) Limited, established in 1993, is a leading Electronics Manufacturing Services (EMS) provider in India, operating across segments like consumer electronics, lighting, home appliances, CCTVs, mobile phones, and reverse logistics. It also produces security surveillance equipment, wearable, audible, and AC-PCBs. The company recently formed a joint venture with Imagine Marketing Pvt Ltd. for wireless audio solutions. As one of India’s largest LED TV manufacturers, Dixon caters to over 35% of the country’s demand and is a leading ODM player in lighting with extensive capacity across SKUs. It has the largest semi-automatic washing machine portfolio with models ranging from 6 kg to 14 kg. Headquartered in Noida, Dixon has 22 manufacturing facilities across India. It plans a capital expenditure of ₹300-400 crore annually over the next two years, alongside debt repayment obligations of ₹90-110 crore per year. Notable achievements include manufacturing 11 million smartphones, 26 million feature phones, and rolling out India’s first ODM-based Google TV solutions. The EMS industry in India is poised for substantial growth, driven by rising domestic consumption, government initiatives like “Make in India” and the production-linked incentive (PLI) scheme, and the increasing shift of global manufacturing supply chains toward India. The demand for electronics across sectors such as consumer durables, telecommunications, and industrial automation has created a favourable environment for companies like Dixon. However, the industry faces challenges such as dependency on imported components and price sensitivity in the domestic market. Despite these hurdles, Dixon Technologies is well-positioned to benefit from the sector’s growth trajectory, given its strong operational capabilities, focus on backward integration, and a robust order pipeline. The company’s proactive approach to expanding its product portfolio and leveraging government support further cements its status as a leader in the Indian EMS landscape.

Latest Stock News

Shares of Dixon Technologies Ltd. saw a significant drop of 14% in trading on Tuesday, January 21, following analysts’ concerns over its valuation after the company’s quarterly results, which largely met expectations. This marked the largest single-day decline for the stock since January 27, 2023, when Dixon had lowered its guidance for the financial year 2024. The company reported a robust 190% growth in its core Mobile business, now accounting for nearly 90% of its total revenue. However, other aspects of the company’s performance were in line with analyst predictions. In a note, Jefferies pointed out that while the mobile production-linked incentive (PLI) scheme is set to expire in 2026, consumer electronics sales had dropped by 32% year-on-year. Goldman Sachs maintained a “sell” rating on the stock with a price target of ₹10,240, even lower than Jefferies’ estimate. Analysts at Goldman Sachs suggested that the earnings upgrade cycle for Dixon might have stalled, and with high valuations and slower growth, the stock may underperform in the near term. Dixon’s future growth is expected to stem from its focus on backward integration, particularly in the display, camera, and battery module assembly sectors. The company also plans to establish a display fab, which could enhance its control over the supply chain and transform it into a more vertically integrated electronics manufacturer. However, the success of these initiatives depends heavily on their execution, making them a critical factor in Dixon’s ability to drive sustained growth moving forward.

Q3 FY24 Earnings

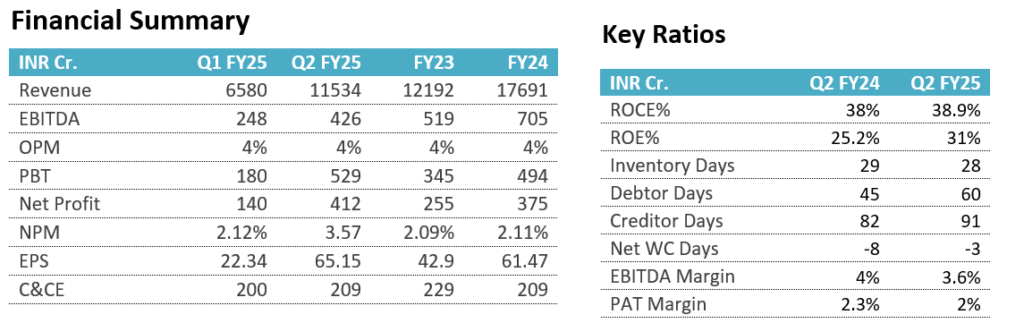

- Revenue of ₹10454 crore in Q3 FY25 up by 117% YoY from ₹4818 crore in Q3 FY24.

- EBITDA of ₹391 crore in this quarter at a margin of 4% compared to 4% in Q3 FY24.

- Profit of ₹216 crore in this quarter compared to a ₹97 crore profit in Q3 FY24.