Adani Power Ltd & Adani Energy Solutions Q3 FY25 Results: Robust Profit and Strategic Expansion in India’s Energy Sector

Adani Power Ltd: Overview

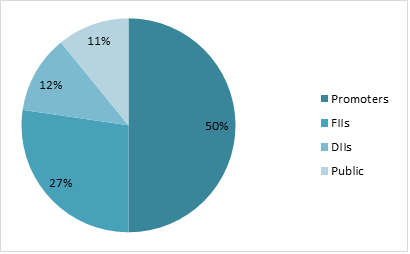

Adani Power Ltd. (APL), a subsidiary of the Adani Group, is one of India’s largest private-sector power producers, focusing on thermal power generation. Established in 1996, the company has grown rapidly, playing a crucial role in meeting India’s increasing electricity demand. It operates a diversified portfolio of coal-based power plants across multiple states, contributing significantly to the country’s energy security. With a total installed capacity of over 15 GW, Adani Power is a key player in India’s electricity sector, supplying power to both state utilities and industrial consumers through long-term Power Purchase Agreements (PPAs) and merchant power sales. The company has also expanded its global footprint, acquiring power assets in countries like Bangladesh and Sri Lanka. India’s power sector is one of the largest in the world, driven by rising electricity consumption, rapid urbanization, and industrialization. The government’s focus on ensuring 24/7 power supply and its ambitious renewable energy targets are shaping the future of the industry. While renewable energy is gaining momentum, thermal power (primarily coal-based) still accounts for over 55% of India’s total electricity generation. Given the country’s vast coal reserves and the need for stable base-load power, coal-fired power plants remain a critical part of the energy mix. However, the sector faces challenges such as coal supply constraints, regulatory changes, and increasing pressure to reduce carbon emissions.

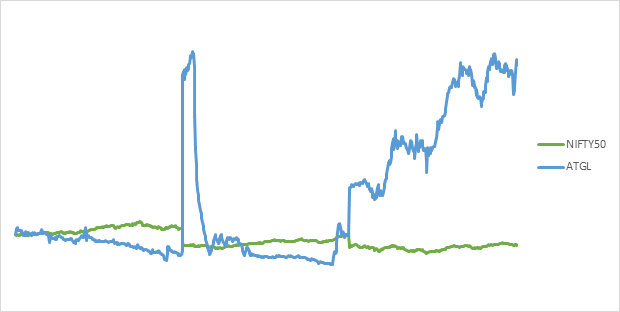

Latest Stock News

Adani Power’s revenue growth remained aligned with volume expansion but was moderated by lower average tariff realization, driven by a decline in import fuel prices and lower merchant tariffs. India is expected to add 80 GW of additional coal-based power capacity by FY 2031-32 to meet the accelerating demand, with 49 GW of this capacity still untapped, presenting significant growth opportunities. APL achieved more than 100% fly ash utilization for Q3 FY25 across almost its entire fleet. Adani Power has identified a 12.52 GW development pipeline to capitalize on this potential. NCLT (Ahmedabad) sanctioned the Scheme of Amalgamation of SMRPL, a wholly owned subsidiary of AEL, with MEL, a subsidiary of APL, vide its order dated 7 th November 2024. Operationally, the Dahanu, Godda, Mahan, and Udupi plants achieved 100% availability in October 2024, while Kawai and Udupi reached the same milestone in December 2024. The company has also made significant progress in reducing its senior term debt through a combination of prepayments and scheduled repayments, despite ongoing acquisitions and organic expansion. Additionally, Adani Power signed a long-term Power Purchase Agreement (PPA) with Maharashtra State Electricity Distribution Company Limited (MSEDCL) for the procurement of 1,496 MW (net) of thermal power during the quarter.

Q3 FY25 Earnings

- Revenue of ₹13671 crore in Q3 FY25 up by 5.23% YoY from ₹12991 crore in Q3 FY24.

- EBITDA of ₹5023 crore in this quarter at a margin of 37% compared to 36% in Q3 FY24.

- Profit of ₹2940 crore in this quarter compared to a ₹2738 crore profit in Q3 FY24.

Adani Energy Solutions Ltd: Overview

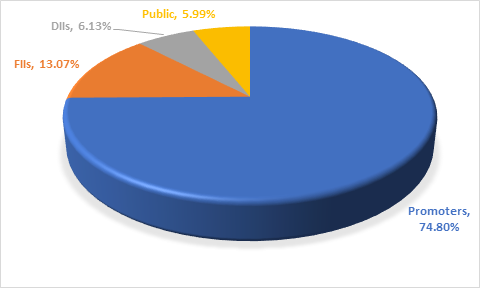

Adani Energy Solutions Ltd is a prominent player in the energy sector, focusing on the generation, distribution, and transmission of electricity. A part of the Adani Group, the company operates across multiple energy segments, including renewable and conventional energy generation, power transmission, and distribution services. With a strong emphasis on sustainability, Adani Energy has invested significantly in renewable energy projects, particularly in solar and wind power, aiming to contribute to India’s growing clean energy needs. The company’s renewable energy capacity is steadily expanding, making it one of the largest green energy companies in the country. Additionally, Adani Energy is involved in power distribution, particularly in the states of Gujarat, Maharashtra, and Chhattisgarh, where it serves both residential and industrial consumers. The industry outlook for the energy sector, especially in India, remains positive, driven by increasing energy demand, a shift towards renewable energy, and government support through various policies and initiatives. India’s commitment to achieving net-zero carbon emissions by 2070 has accelerated the growth of renewable energy investments, with significant capacity additions expected in the coming years. The country is on track to increase its renewable energy capacity to 500 GW by 2030, with solar and wind power playing pivotal roles in achieving this target.

Latest Stock News

EBITDA for the quarter grew by 6%, reaching Rs 1,831 crore, driven by strong revenue growth, EPC income from transmission, treasury income, and stable regulated EBITDA from AEML. The company secured two new transmission projects – Khavda Phase IV Part-D and Rajasthan Phase III Part I (Bhadla – Fatehpur HVDC), adding 3,044 ckm to its under-construction network. With five new projects won this year, the under-construction transmission pipeline has surged to approximately Rs 54,761 crore in Q3FY25, up from Rs 17,000 crore. AESL significantly increases its capex ramp-up driven by unparalleled project and operating excellence coupled with robust capital management program. The capital expenditure (capex) for 9MFY25 rose to Rs 7,475 crore, compared to Rs 3,784 crore in the same period last year. The company is progressing well with a robust under-construction project pipeline, which includes 13 projects worth Rs 54,761 crore. The under implementation pipeline stands at 22.8 million smart meters, comprising nine projects with a revenue potential of over Rs 27,195 crore. The deployment of smart meters is also on track, with an average run-rate of 15,000 meters per day, expected to increase to 20,000 meters per day by the next quarter. In Q3FY25, the capex amounted to Rs 3,074 crore, which is three times higher than the Rs 1,162 crore spent in Q3FY24.

Q3 FY25 Earnings

- Revenue of ₹5830 crore in Q3 FY25 down by 27.8% YoY from ₹4563 crore in Q3 FY24.

- EBITDA of ₹1661 crore in this quarter at a margin of 28% compared to 32% in Q3 FY24.

- Profit of ₹625 crore in this quarter compared to a ₹348 crore profit in Q3 FY24.