Pearl Global Industries Faces Trend Reversal Amid Market Volatility, Stock Analysis and Growth Prospects

Business and Industry Overview:

Pearl Global Industries Ltd. (PGIL) is a big company making famous brands’ clothes. It started in 1987 with Deepak Kumar Seth as its leader. The company designs, creates, and delivers different types of clothes like t-shirts, pants, sweaters, and dresses for men, women, and children. PGIL has 21 factories in India, Indonesia, Bangladesh, and Vietnam and design centres in many countries, including the USA, UK, and Spain. It works with over 82 big brands like GAP, JC Penney, Banana Republic, and Wal-Mart. PGIL earns a lot of money and is growing fast. As of March 13, 2025, its market value is ₹6,907 crore, and its share price is ₹1,502. It makes smart use of money and gives good returns to investors. The company wants to make high-quality clothes using new ideas and technology while protecting the environment. PGIL is successful because it has factories in many countries, makes different types of clothes, has a big team of designers, delivers clothes on time, and follows eco-friendly methods. The company keeps growing and helps fashion brands get the best clothes quickly and responsibly.

India is one of the biggest makers of clothes and fabrics in the world. It produces cotton, silk, and denim, which are loved in many countries. Indian clothes are sold in big fashion markets. The textile industry is very important for India’s economy. India also sells a lot of clothes to other countries. It is the sixth-largest seller of textiles in the world. The USA, UK, UAE, and Germany buy a lot of Indian fabrics. In 2023–24, India earned billions of dollars from selling textiles. The government wants to sell even more and is making trade deals with different countries.

In 2024, India held a big event called Bharat Tex in New Delhi. Many famous brands and buyers from different countries came to see Indian textiles. This event helped Indian businesses make deals and increase sales.

An organisation called the Apparel Export Promotion Council (AEPC) helps businesses sell Indian clothes in other countries. The Indian textile industry is growing fast. With government support, better technology, and high demand, India will continue to be a top country for making and selling clothes.

Pearl Global Industries Ltd. makes and sells clothes to big fashion brands all over the world. It has factories in India, Bangladesh, Vietnam, and Indonesia. This helps the company make clothes faster and at lower costs. By having factories in different countries, it can deliver orders on time and serve many customers.

Latest Stock News:

Pearl Global Industries’ stock reached a 52-week high of ₹1,360.75 per share, showing a 109.80% rise in the past year, much higher than the Sensex. However, on March 13, 2025, the stock fell sharply after a short period of gains. Despite this drop, the company has performed well over the last three years. The broader market also faced a decline on the same day. The company earns 60% of its revenue from the US, followed by Spain, the UK, Japan, and Australia. Even with US President Donald Trump’s plan for new tariffs, Pearl Global is not worried. Managing Director Pallab Banerjee assured that the company has strategies to manage risks and continue growing.

Potentials:

Pearl Global Industries wants to expand its business and sell clothes in more countries. It plans to work with big brands in the US, Europe, and other important markets. The company will increase production by using better machines and advanced technology. This will help make clothes faster, better, and at lower costs. Pearl Global also focuses on the environment and will use eco-friendly materials and safe manufacturing methods. It wants to reduce waste and save energy in its factories. The company will create a wider range of clothes to match new fashion trends and customer needs. It also plans to improve online sales and reach more customers through digital platforms. By doing all this, Pearl Global aims to grow, compete with other companies, and stay successful for many years.

Analyst Insights:

- Market capitalisation: ₹ 6,274 Cr.

- Current Price:₹ 1,366

- 52-Week High/Low: ₹ 1,718 / 524

- Stock P/E: 29.3

- Dividend Yield: 0.64 %

- Return on Capital Employed (ROCE): 21.4 %

- Return on Equity: 21.9 %

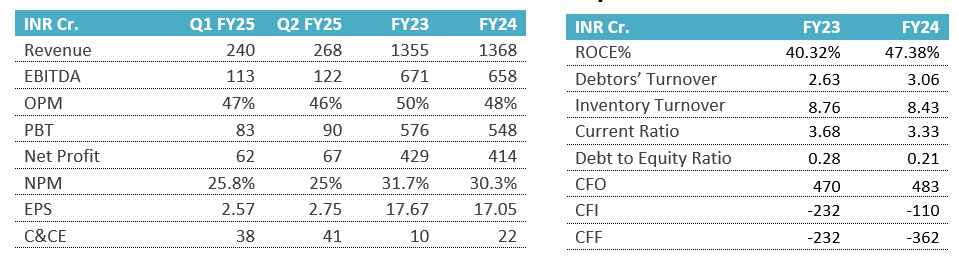

Pearl Global Industries Ltd has grown fast in the last three years, with sales rising 32% yearly and profit jumping 172% yearly. The company makes more money on each sale now, with profit margins improving from 6% to 9%. It also collects payments faster, reducing its waiting time from 58 days to 41 days. Its latest profit growth of 43% is better than that of competitors like K P R Mill (8.12%) and Vedant Fashions (0.17%). The stock has fallen 10.62% recently, making it a good time to buy. However, the high P/E ratio (29.3) and promoters selling some shares raise concerns. Investors should buy this stock on a dip.