Ventive Hospitality Faces 4.4% Dip as 56 Lakh Shares Unlock, Still Above IPO Price

Business and Industry Overview:

Ventive Hospitality is a part of Panchshil Realty. It owns, builds, and manages luxury and business hotels. The company focuses on providing top-quality service, comfort, and great experiences. It operates 11 hotels in India and the Maldives. Some of its well-known hotels are JW Marriott Pune, The Ritz-Carlton Pune, DoubleTree by Hilton Pune, and Conrad Maldives Rangali Island. Ventive is also expanding. It is building new hotels in Varanasi and Sri Lanka. Ventive does more than just hotels. It also manages office spaces and shopping areas near its properties. These spaces help guests enjoy work, shopping, and relaxation in one place.

India’s hospitality industry is growing fast because more people are traveling for work, vacations, and medical treatments. India is famous for its history, culture, and beautiful places. Many tourists from India and other countries visit every year. The government is working to improve travel and tourism. It is building better roads, airports, and hotels. It has also started programs to improve popular tourist places. The Swadesh Darshan Scheme is making special routes for travelers. The PRASHAD Scheme is improving temples and other religious places. Many people come to India for medical and wellness tourism. 21% of foreign tourists visit India for health treatments and relaxation. The travel market is expected to grow from $75 billion in 2020 to $125 billion by 2027. More than 30.5 million foreign tourists are expected to visit India by 2028. The hotel and tourism industry added $199.6 billion to India’s economy in 2022. More travelers mean more hotels are opening. Many international hotel brands are coming to India. In 2024, the government gave $294.8 million for tourism, which is 44.7% more than the previous year. Foreign companies are also investing in Indian hotels and tourism. By June 2024, India received $17.26 billion in foreign investments in this sector. India is ranked 10th among 185 countries for how much tourism helps its economy. The industry is also creating more jobs. By 2029, it is expected to provide 53 million jobs. With more tourists, better hotels, and new investments, India’s hospitality industry will grow even more. The government is helping the industry with better facilities and more promotions. India is on its way to becoming one of the world’s top travel destinations.

Ventive Hospitality is a leading company in the hotel and tourism industry. It is part of Panchshil Realty, a big real estate company known for luxury buildings. Ventive Hospitality owns and manages high-end hotels and resorts in India and the Maldives. It works with famous brands like JW Marriott, The Ritz-Carlton, and Hilton to provide top-quality service. The company chooses prime locations like Pune, Bengaluru, and the Maldives to attract both business and leisure travelers. Unlike regular hotels, Ventive Hospitality also manages office and retail spaces near its hotels. This makes it easy for business travelers to work and relax in one place. The company also cares about the environment and follows eco-friendly practices. With strong financial support from Panchshil Realty, Ventive Hospitality is growing fast and expanding to Varanasi and Sri Lanka. Its focus on luxury, business, and sustainability makes it a strong competitor in the hospitality industry.

Latest Stock News:

Ventive Hospitality recently had 56 lakh shares, or 2% of its total shares, become available for trading after a three-month lock-in period ended. This means that early investors, who were restricted from selling their shares for a set time, can now sell them in the market. As a result, the stock dropped by 4.4% because more shares being available can sometimes lead to selling pressure. Despite this, the stock is still above its IPO price of ₹643, though it is 12% lower than its highest point after listing. At the same time, the overall hotel sector is doing well. On Friday, Ventive Hospitality’s stock hit ₹810.40, up 5%, and ITC Hotels also rose by 6%, reaching ₹193.35. This increase happened because investors are optimistic about the hospitality sector’s future. The industry expects strong demand to continue in the January-March 2025 quarter (Q4FY25), mainly due to business travel and events like meetings, conferences, and exhibitions (MICE). Hotel companies in India have said that the demand for leisure travel remains strong. They expect this trend to continue in the next quarter and throughout the next financial year. Factors like weddings, large regional events, and regular travel are expected to keep the hospitality industry growing.

Potentials:

Ventive Hospitality Ltd. is backed by Blackstone Group and Panchshil Realty. The company plans to double its portfolio to over 5,000 keys in the next three to five years. It will achieve this by developing new properties and acquiring existing ones. It will also use the rights of first offer on certain assets. Ventive Hospitality aims to expand in both domestic and international markets. It has upcoming projects in Varanasi, India, and Sri Lanka. The company is also integrating hospitality services with commercial and retail spaces. This will create a complete experience for guests. Ventive Hospitality is committed to sustainability and eco-friendly practices. This aligns with the growing demand for responsible tourism. The company has strong financial support from Panchshil Realty and Blackstone. This will help it grow further and become a leader in the hospitality industry.

Analyst Insights:

- Market capitalisation: ₹ 16,535 Cr.

- Current Price: ₹ 708

- 52-Week High/Low: ₹ 812 / 523

- Stock P/E: 100

- Dividend Yield: 0.00%

- Return on Capital Employed (ROCE): 34.5%

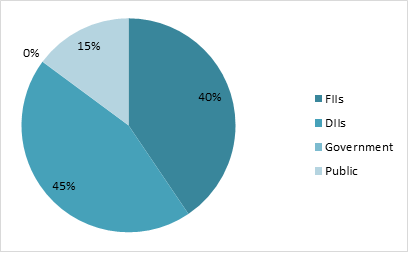

Return on Equity: 12.9 %Ventive Hospitality Ltd. is growing fast. Its revenue increased from ₹431 Cr. in FY23 to ₹478 Cr. in FY24. The company also made more profit, earning ₹166 Cr. It has a strong profit margin of 59% and a high return on equity (ROE) of 65.7%, which shows it is using its money well. Ventive plans to double its hotels to 5,000 rooms in 3-5 years, with new projects in Varanasi and Sri Lanka. The hotel industry is doing well, with more business travel and events. But the stock is expensive, with a P/E ratio of 100.14, meaning it costs more than some competitors. Recently, 56 lakh shares became available for sale, causing the price to drop by 4.4%. Despite this, the company has strong support from its owners (88.99% promoter holding) and is expected to grow. It is a good stock for the long term, but it may be better to buy at a lower price.