Colgate-Palmolive (India) Q3 FY25: Strong Growth, Market Leadership & Future Potential

Colgate Palmolive (India) Ltd: Overview

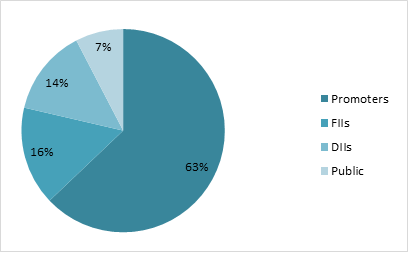

Colgate-Palmolive (India) Ltd. is a leading player in the Indian oral care and personal care industry, with a strong brand presence and a legacy of over eight decades. Established in 1937 and headquartered in Mumbai, the company is a subsidiary of Colgate-Palmolive Company, USA. It dominates the oral care segment in India with its flagship brand “Colgate,” which enjoys high consumer trust and widespread market penetration. The Indian oral care industry is highly competitive, with increasing consumer demand for premium, natural, and innovative dental hygiene solutions. With a growing focus on personal care and hygiene, the company continues to expand its product portfolio by introducing new offerings in toothpaste, toothbrushes, mouthwashes, and personal care products. The company has a strong distribution network covering urban and rural markets, ensuring deep market penetration. Colgate-Palmolive (India) Ltd. is also focusing on sustainability, investing in eco-friendly packaging and sustainable sourcing initiatives. With a consumer-driven approach and technological advancements, the company remains a leader in India’s oral care industry while expanding its footprint in adjacent categories.

Latest Stock News

Colgate-Palmolive (India) has had a strong run, with seven straight quarters of over 5% growth and the last three in double digits. Despite tough market conditions, the company is growing faster than both the FMCG industry and its listed competitors. In the first half of FY24, its growth was 2.4 times the industry average—a result that reinforces its strategy of consistent, competitive performance. Gross margins remain solid at 68-70%, and while EBITDA margins saw a big jump last year, they are expected to stabilize. Colgate’s brand dominance is a major strength—found in nine out of ten Indian homes, it remains the most recognized and trusted name in oral care. Brand recall has strengthened, and consumers increasingly see Colgate as the expert in oral health, which helps drive market share.

The toothpaste market has slowed in urban India, but rural demand, while steady, is also levelling off. On the other hand, toothbrush sales continue to rise, with rural markets now growing faster than urban ones. Colgate’s strategy remains steady: grow the oral care category, strengthen its key brands (Strong Teeth, Maxfresh, and Salt), premiumize through innovation, and expand toothbrushes and personal care. India still has huge potential for growth—people here use much less toothpaste than in similar countries, and daily brushing habits are far from universal. Only 20% of urban consumers brush twice a day, and in rural areas, half don’t even brush daily. Increasing brushing habits and upgrading toothbrushes are key opportunities. With its strong execution, Colgate is well-positioned to lead the market and drive long-term growth.

Business Segments

- Oral Care: Oral care is Colgate-Palmolive India’s primary revenue-generating segment, contributing a significant portion to its overall sales. The company leads the toothpaste and toothbrush market with brands such as Colgate Strong Teeth, Colgate Total, Colgate MaxFresh, Colgate Sensitive, and Colgate Vedshakti. It continuously innovates by introducing advanced formulations catering to varied consumer needs, including herbal, sensitivity relief, and whitening solutions. The company has also expanded into mouthwashes with products like Colgate Plax.

- Personal Care: Colgate-Palmolive India has a presence in the personal care segment through its Palmolive brand, which includes a range of shower gels, hand washes, and liquid soaps. The segment has been growing steadily as consumers prioritize hygiene and self-care. The company is leveraging its global expertise to introduce premium skincare and wellness products tailored to Indian consumers.

- Home Care: Under the home care segment, the company offers cleaning and hygiene solutions. Though this segment contributes a smaller portion of total revenue, Colgate-Palmolive (India) Ltd. continues to expand its presence in this category.

Subsidiary Information

- Colgate-Palmolive (Nepal) Pvt Ltd: This subsidiary helps the company expand its market reach in South Asia, particularly in Nepal, where Colgate products have a significant consumer base. It supports manufacturing, distribution, and marketing efforts tailored to regional preferences.

- Colgate Global Business Services Pvt Ltd: This subsidiary provides back-end operational support, including finance, human resources, and IT services, to Colgate-Palmolive’s Indian and global operations. It plays a crucial role in optimizing business efficiency.

- Colgate-Palmolive (Myanmar) Ltd: With an increasing focus on emerging markets, this subsidiary allows Colgate-Palmolive India to expand its brand footprint in Myanmar. The company leverages its Indian manufacturing and supply chain to cater to the growing demand in the Southeast Asian market.

- Colgate-Palmolive India Consumer Products Ltd: This subsidiary is focused on exploring new consumer segments and diversifying into adjacent product categories beyond oral care. It supports research and development initiatives aimed at catering to evolving consumer preferences.

- Colgate-Palmolive India Supply Chain Pvt Ltd: Responsible for optimizing logistics and distribution, this subsidiary ensures seamless supply chain operations across India and neighboring markets. It plays a key role in maintaining Colgate’s market leadership by ensuring product availability and efficient distribution.

Q3 FY25 Earnings

- Revenue of ₹1462 crore in Q3 FY25 up by 4.7% YoY from ₹1396 crore in Q3 FY24.

- EBITDA of ₹454 crore in this quarter at a margin of 34% compared to 31% in Q3 FY24.

- Profit of ₹323crore in this quarter compared to a ₹330 crore profit in Q3 FY24.

Financial Summary

| Amount in ₹ Cr | Q3 FY24 | Q3 FY25 | FY23 | FY24 |

| Revenue | 1396 | 1462 | 5226 | 5680 |

| Expenses | 927 | 1007 | 3679 | 3779 |

| EBITDA | 468 | 454 | 1547 | 1901 |

| OPM | 34% | 31% | 30% | 33% |

| Other Income | 18 | 20 | 42 | 57 |

| Net Profit | 330 | 323 | 1047 | 1324 |

| NPM | 23.7% | 22.1% | 20.3% | 23.3% |

| EPS | 12.1 | 11.9 | 38.5 | 48.67 |