Narayana Hrudayalaya Q2 Results: Revenue Growth Despite 12.3% Decline in Net Profit

Company Overview

Narayana Hrudayalaya Ltd. (also known as Narayana Health) is one of India’s leading healthcare providers, headquartered in Bengaluru, Karnataka. Founded in 2000 by renowned cardiac surgeon Dr. Devi Prasad Shetty, the company has grown into a comprehensive healthcare network with a strong focus on affordable and accessible care. Narayana Health specializes in high-quality tertiary and quaternary care across a range of specialties, particularly in cardiology and oncology. Narayana Health operates over 20 hospitals and 7 heart center across India, with a strong presence in both urban and semi-urban areas. The company also has an international hospital in the Cayman Islands.

Industry Outlook

The Indian healthcare industry was valued at approximately $280 billion in 2022 and is projected to reach $532 billion by 2028, growing at a CAGR of around 10-12%. The government’s PLI scheme for the pharmaceutical and medical device industries aims to boost local production and reduce dependence on imports, potentially lowering healthcare costs in the long term. India faces a shortage of hospital beds, with about 1.3 beds per 1,000 people, below the WHO recommendation of 5. While there is progress, addressing this gap, especially in rural areas, remains a priority. About 70% of India’s population lives in rural areas but has limited access to healthcare. Expanding healthcare facilities in these areas and increasing the availability of affordable care are crucial for balanced sector growth.

Business Mix

- Owned Hospitals: Its where company owns the hospitals and operates the patients and handle their works. It contributed ₹817 crore in Q2 FY25 revenue of the company.

- Operated Hospitals: It has a portfolio of hospitals where it does not own them but operates in it. It has contributed about ₹315 crore in this quarter.

- Heart Centers: The Company has its own Heart center in India, where it treats the patients with their extraordinary skills. It has contributed ₹17.5 crore for Q2 FY25.

- Other Ancillary Business: It provides equipments to other hospitals for surgery or other operations to perform. It earned a revenue of ₹17 crore this quarter.

- Specialty Profile: It includes the treatment and facilities of Cardiac Science, Oncology, Neuro Sciences, Medicines and GI sciences, renal sciences, Orthopedics and others, in their hospitals.

Quarterly Highlights

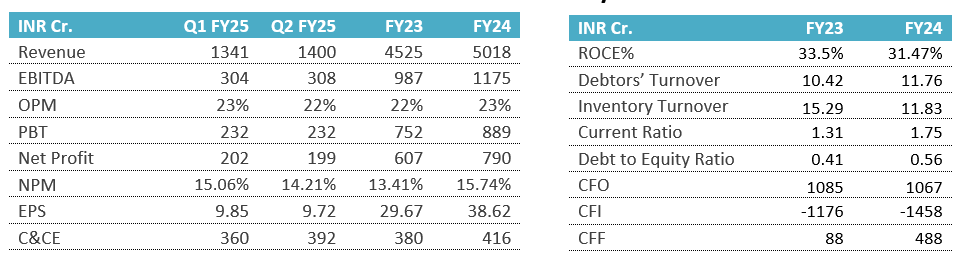

- Revenue of ₹1167.7 crore in Q2 FY25 up by 10.9% YoY from ₹1052.7 crore in Q2 FY24.

- EBITDA of ₹308 crore in this quarter at a margin of 22% compared to 24% in Q2 FY24.

- Profit of ₹199 crore in this quarter compared to a ₹227 crore in Q2 FY24.

- Domestic revenue is ₹1081.6 crore up by 13.5% YoY & International revenue is ₹76.2 crore down by 19.2% YoY.

Business Highlights

- The patient footfalls including day care business is 710,000 in Q2 and the Average revenue per Patient is ₹135,000.

- Narayana Health has total 40 facilities & 5789 operational beds, from which 2 facilities and 128 beds for Heart centers.

- The capex of ₹534 crore is expected for FY25. The capex is used for Facility Improvement, medical equipment purchase and new investment in Land, hospital constructions and clinics, etc.

Financial Summary and Key Ratios

SWOT Analysis:

Strengths

- Affordable Healthcare Model – Known for providing cost-effective healthcare solutions.

- Extensive Network – A broad reach that enhances accessibility for patients.

- Specialized Expertise – Strong focus on specialized medical services and treatments.

- Reputable Brand – Trusted brand with a strong reputation in the healthcare industry.

Weaknesses

- Geographical Limitations – Presence concentrated in specific regions, limiting reach.

- Low Profit Margins – Cost-focused model results in slimmer profit margins.

- High Operational Expenses – Substantial running costs impact overall profitability.

Opportunities

- Expansion into Tier 2 & 3 Cities – Opportunity to grow in emerging urban areas with increasing healthcare needs.

- Rising Demand for Healthcare – Growing population and healthcare awareness drive demand.

- International Growth – Potential to expand services globally and tap new markets.

- Focus on Wellness Services – Increasing interest in wellness services opens new revenue channels.

Threats

- High Competition – Competing with numerous healthcare providers for market share.

- Changing Regulations – Frequent shifts in healthcare regulations create operational challenges.

- Economic Uncertainty – Economic downturns can reduce patient spending on non-essential healthcare services.