ITC Stock Hits 52-Week Low Amid Tax Concerns- Is It a Buy Opportunity?

Business and Industry Overview:

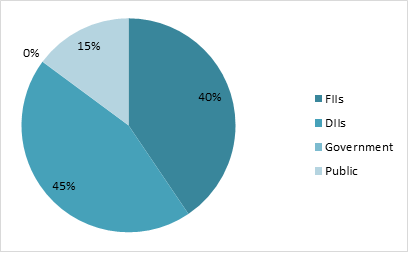

ITC (Indian Tobacco Company) is one of India’s largest conglomerates in the FMCG Industry. It has a wide range of businesses across the country. Established in 1910, ITC is the largest cigarette manufacturer and seller in the country. ITC operates in five business segments at present — FMCG Cigarettes, FMCG Others, Hotels, Paperboards, Paper and Packaging, and Agri-Business. It also has ITC Infotech, its IT division, which offers digital solutions all over the world. ITC India was voted the “Most Admired” company by Fortune India. In terms of market capitalization, ITC is the second-largest FMCG company in India and the third-largest tobacco company in the world. As of March 2024, British American Tobacco is the largest shareholder in the company with a 25.5% stake, followed by Life Insurance Corporation of India, which holds 15.2%.

CRISIL forecasts 7-9% revenue growth for the FMCG sector in the current FY25, driven by increased volume and rural demand recovery. The Fast-moving Consumer Goods (FMCG) sector is India’s fourth-largest sector and has been expanding at a healthy rate over the years because of rising disposable income, a rising youth population, and rising brand awareness among consumers. With household and personal care accounting for 50% of FMCG sales in India, the industry is an important contributor to India’s GDP. ITC is the largest company in the FMCG industry in India, with 80% of the market share.

Latest Stock News:

Recently, ITC’s stock has dropped 9% to a 52-week low of ₹396.2. This happened because the investors were concerned about a potential increase in cigarette taxes from 28% to 40% owing to GST. This is being reflected in the stock market and is the cause of the reduction of market price. The increased taxes might lower ITC’s earnings, which would cause its stock to drop even further.

On February 6, 2025 the company announced that ITC has signed an agreement to buy Prasuma, a well-known brand in frozen, chilled, and ready-to-cook foods like momos, baos, and Korean fried chicken. Prasuma offers 170+ products and focuses on healthy, high-quality food. This deal will help ITC expand in the fast-growing frozen food market, which is worth over ₹10,000 crores. ITC will fully acquire Prasuma in 3 years. It will first buy 43.8% of the company now and the remaining shares in phases by June 2028, based on a set valuation and other agreed conditions.

In July 2023, ITC Limited’s board of directors approved the demerger of its hotel business and the formation of a wholly owned subsidiary called ITC Hotels. The demerger came into effect on 1 January 2025.

With the declaration of the company’s Q3 result, the Board recommends an Interim Dividend of Rs. 6.50 per share for the Financial Year ending 31st March 2025.

Potentials:

ITC’s growth is stable but not very fast. Its stock fell 9% to a 52-week low because of worries about a tax increase on cigarettes from 28% to 40%, which could hurt profits. As a major, the company’s profit comes from cigarettes; an increase in the tax rate of cigarettes can significantly affect the financials of the company. In January 2025, ITC separated its hotel business to focus more on FMCG, paper, and agriculture, which may help profits. Though its sales growth has been slow (7.95% in five years), ITC is financially strong and has low debt, a 27.5% ROE and a 3.42% dividend yield. It also announced a ₹6.50 per share dividend for FY 2025, making it a good option for steady-income investors. The company plans to invest Rs. 20,000 Cr in the medium term across all its businesses to enhance structural competitiveness.

Analyst Insights:

ITC is financially strong, with low debt, a high 27.5% ROE, and a 3.42% dividend yield. It pays 92.4% of its profits as dividends, making it great for investors looking for steady income. However, its sales growth has been slow (7.95% in five years), which could limit future expansion. This means ITC is a stable investment for consistent returns but may not grow quickly as it is in the mature stage of its business cycle.

The company has strong fundamentals and has the ability to bounce back from its 52-week low market price. The investors who already hold the shares should wait and see because if the tax rate on cigarettes is increased, it might affect the profitability in the short run, but the company can provide a stable return overall in long run.

For the investors who are willing to take risks, they can buy the stock and expect a good return in the long-term future.