Jai Corp Ltd: Gain 3% as NCLT Clears Pet Fibres-Share Buyback in Focus

Jai Corp Limited: Overview

When Jai Corp Limited was first established on June 6, 1985, it produced a variety of goods, including spun yarn, PP Staple Fiber, FIBC Jumbo Bags, woven bags and fabrics, and geotextiles. Since then, businesses have expanded into real estate development, coils, and sheets of CR steel.

As time went by, the company diversified into areas such as SEZ development, infrastructure projects, venture capital, and investment advisory services, reflecting the ability to adapt to opportunities that emerged. The company started its commercial production in 1987 with an HDPE/PP Woven Sacks manufacturing unit at Murbad, Maharashtra. The company then further expanded in 1990 and 1992 with other facilities. During the years, Jai Corp restructured itself several times. Notably, it changed its name from Jai Fibres Ltd to Jai Corp Limited in 1994 and also acquired subsidiaries in 2007 to enhance its presence in the venture capital and infrastructure sectors. To demonstrate its infrastructure-oriented strategy, Jai Corp established SPVs for electricity generation, transmission, and distribution in SEZ areas. In 2007–2008, the company ventured into the international market of real estate by incorporating a subsidiary in Mauritius. The group dissolved its Section 8 trust and merged its subsidiary, Jai Realty Ventures, with the aim to concentrate on its core business and streamline operations.

Financial history indicates significant preference shares redemption in focus by Jai Corp. Some examples include between 2014 to 2019, there were several tranches of preference shares redeemed at premium with shareholder approvals for periodic rollover. In 2020, it was an order from National Company Law Tribunal approving the amalgamation of Jai Realty Ventures with the parent company to simplify corporate structure. The firm has also shown resilience under the COVID-19 pandemic where it managed to reopen facilities in stages and ended non-core operations such as spinning during 2020.

Latest News (02-Jan-2025)

Shares of Jai Corp Ltd gained 3% on August 27 after the NCLT approved the merger of promoter company Pet Fibres with Mega Pipes. Following the merger, Pet Fibres’ 2 lakh equity shares (0.2% stake) in Jai Corp will be transferred to Mega Pipes.

Shareholders are advised to update or transfer their Depository Participant (DP) account details as shares in Pet Fibres’ DP account with ILFS will move to Mega Pipes’ DP account with MOSL.

Jai Corp, established in 1985, is a diversified manufacturer specializing in steel, plastic processing, and spinning yarn, while expanding into SEZs, infrastructure, venture capital, and real estate.

In its April-June earnings, Jai Corp reported a 4.56% YoY increase in revenue and a 148% YoY surge in net profit. The Board is set to meet on August 29 to discuss a potential share buyback.

As of 12:10 pm, Jai Corp shares were trading 0.745% higher at ₹389.50 on the NSE.

Returns Summary

| YTD | 1 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year |

| -24.15% | -33.72% | -39.77% | -37.89% | 63.20% | 101.46% | 154.00% |

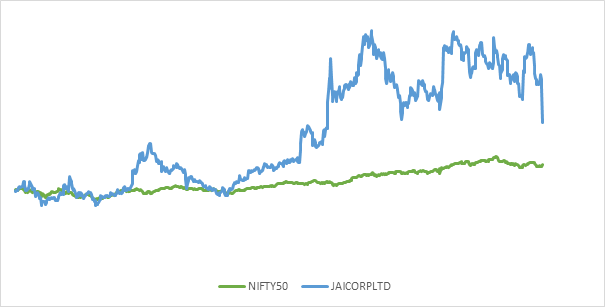

3 Years Return: Jai Corp Ltd. v/s Nifty 50

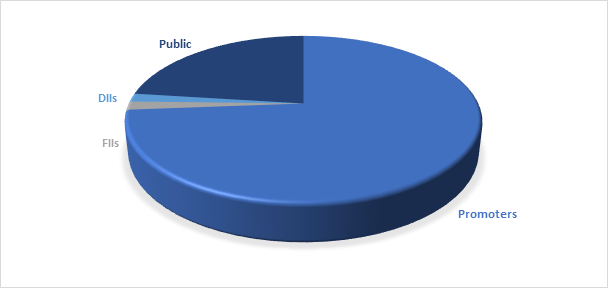

Shareholding Pattern

Key Metrics

| Metrics | – |

| Mkt Cap (INR Cr): | 4,441 Cr. |

| 52-week H/L: | 438/248 |

| PE Ratio: | 66.46 |

| Dividend yield: | 0.20% |

| ROCE: | 3.81% |

| P/B: | 2.98 |

| NSE Code: | JAICORPLTRD |

Financial Trends

| Year | Sales (₹ Cr) | Operating Profit (₹ Cr) | OPM (%) | Net Profit (₹ Cr) | EPS (₹) | Reserves (₹ Cr) | Borrowings (₹ Cr) | Fixed Assets (₹ Cr) | Debt/Equity |

| Mar-18 | 588 | 63 | 11% | -1 | -0.11 | 1,104 | 622 | 274 | 0.56 |

| Mar-19 | 636 | 71 | 11% | -108 | -6.06 | 1,016 | 580 | 279 | 0.57 |

| Mar-20 | 527 | 45 | 9% | 34 | 1.88 | 1,048 | 470 | 256 | 0.45 |

| Mar-21 | 472 | 48 | 10% | 93 | 5.19 | 1,139 | 330 | 230 | 0.29 |

| Mar-22 | 720 | 55 | 8% | 53 | 2.95 | 1,197 | 236 | 224 | 0.2 |

| Mar-23 | 594 | 44 | 7% | -14 | -0.76 | 1,178 | 239 | 225 | 0.2 |

| Mar-24 | 463 | 48 | 10% | 52 | 2.94 | 1,233 | 236 | 213 | 0.19 |

Peer Comparison

| Company | Price (Rs.) | MCAP (Cr.) | P/B | P/E | EPS (Rs.) | ROE (%) | ROCE (%) | P/S | EV/EBITDA |

| Jai Corp | 247.9 | 4,441.00 | 2.98 | 66.46 | 4.13 | 3.98 | 3.81% | 9.52 | 44.12 |

| EPL | 263.5 | 8,361.67 | 8.51 | 39.86 | 6.58 | 19.84 | 18.6 | 6.53 | 23.5 |

| Responsive Inds | 262.65 | 6,902.50 | 7.37 | 206.02 | 1.26 | 3.48 | 5.6 | 10.54 | 63.87 |

| Shaily Engg. Plastic | 1,511.70 | 6,848.56 | 15.25 | 167.64 | 8.89 | 8.75 | 11.07 | 11.12 | 63.42 |

| Jain Irrigation Sys | 74.42 | 4,984.55 | 1.03 | 391.32 | 0.19 | 1.19 | 5.08 | 1.3 | 16.53 |

| Prince Pipes & Fitti | 430.35 | 4,754.68 | 3.02 | 36.11 | 11.91 | 12.55 | 16.25 | 1.85 | 16.88 |

| Polyplex Corporation | 1,369.40 | 4,299.20 | 6.27 | 5,243.11 | 0.26 | -1.33 | -1.36 | 3.04 | 83.13 |

| Jindal Poly Films | 976.4 | 4,260.20 | 0.69 | 8.52 | 114.21 | 5.53 | 7.3 | 7.84 | 7.63 |

| Kingfa Science | 3,471.00 | 4,159.94 | 6.37 | 30.99 | 110.83 | 23.24 | 30.26 | 2.8 | 20.39 |

| Xpro India | 1,532.90 | 3,410.24 | 5.74 | 71.12 | 21.62 | 12.29 | 15.04 | 7.33 | 39.97 |

Stock Analysis

Jai Corp. Ltd. is a diversified company operating in the steel industry. Plastic production and ownership Facing a growing market trend, on January 2, 2025, Urban Infrastructure Holdings Private Limited (UIHPL) fell 19.99 % to ₹248.40 due to planned capital reduction by Jai Corp. over the last five years. The company’s sales growth was very negative at -6.14%, indicating problems with generating income. It is reported to be low. This may raise concerns among investors about the company’s ability to create dust in the stock market. The sudden change in the share price is the result of UIHPL’s planned capital reduction, which has raised concerns about the impact on Jai Corp’s financial health and future cash flows. Considering the new market reaction and related economic factors. Investors should be watchful: High P/L ratio signals that a stock may be overvalued. Negative output growth over five years indicates a structural situation. According to the report, UIHPL’s equity market is under uncertainty that would affect Jai Corp’s financial position. Some reported lower quarterly earnings and revenue. Broader economic indicators and current market conditions suggest caution. An investor should not scrutinize the financial condition and history of a company before investing.

Considering all these factors investors are recommended to remain watchful as mentioned in the above para. Don’t invest until some major changes happens in the company’s operation. Wait for the right time to make entry!