Suzlon Energy Stock Falls 17% – Temporary Setback or Long-Term Opportunity?

Business and Industry Overview:

Suzlon Energy Ltd is an Indian company. It makes wind turbines. It gives clean energy solutions. It started in 1995. The founder is Tulsi Tanti. The head office is in Pune, Maharashtra. The head office is called “One Earth”. It is a green building. It has Platinum LEED and GRIHA 5-star rating. It is one of the greenest office campuses in the world. Suzlon Group is a top company in clean energy. It is helping the world use more clean energy. Suzlon works in 17 countries. These include Asia, Australia, Europe, Africa, and the Americas. Suzlon has strong skills in clean energy systems. It makes good and strong products. It also does research and development (R&D). It has over 20 years of experience. Its systems give high output and more returns to customers. Suzlon has set up over 20,940 MW of wind power in the world. The company cares about nature, people, and growth. It works in a clean and responsible way. In the past, Suzlon had money problems. But now it is doing well. In August 2024, its market value became ₹1 lakh crore. In May 2024, Suzlon got a big order. It is from Juniper Green Energy. The project is for 402 MW of wind power in Rajasthan. Suzlon will install 134 wind turbines. Each turbine has 3 MW of power. But they also said there are some work challenges. Suzlon wants to give clean energy. It wants to grow and help the world use green power.

Latest Stock News:

Suzlon Energy is a clean energy company. It makes wind turbines. As of April 10, 2025, the stock price has moved up and down many times. On April 9, the stock fell by 3.64%. It touched ₹51.45 during the day. This fall was more than other clean energy companies, which fell 2.46%. In the last week, the stock went down by 10.84%. In the last month, it fell by 6.85%. In 2025, it will have fallen by 17.79%. But in the long term, the stock did well. In the last 3 years, it went up by 367.84%. In the last 5 years, it went up by 2095.52%. On April 7, 2025, the stock opened at ₹46.90. This was a big drop of 15.34% from ₹55.40 on April 4. It later went up to ₹51.02. The drop happened because the company got a fine. The fine was for not paying customs duty. In March 2025, the company said some orders were cancelled or made smaller. These orders were from January. But still, the total order size became bigger. It went from 5,523 MW on January 28 to 5,622 MW on March 28. Experts from Motilal Oswal gave a “buy” rating for the stock. They gave a target price of ₹70. This means the stock may go up by 21.5%. So, even with problems, many people still believe the company has a good future.

Potentials:

Suzlon Energy has announced a very big achievement. The company received India’s largest-ever wind energy order from NTPC Green Energy Limited (NGEL). NGEL is the renewable energy branch of NTPC Limited, which is the biggest government energy company in India. This order is for 1,166 megawatts (MW) of wind energy. As part of this deal, Suzlon will install 370 wind turbines. Each turbine will have a power capacity of 3.15 MW. These turbines are the S144 model, and they will be placed on special Hybrid Lattice Tubular (HLT) towers. The entire project will be set up in three different locations in Gujarat. The electricity made from these wind turbines will be able to power around 3 million homes. This is a very large project and will be the first time a government company (PSU) is doing such a big wind energy project in India. It will also help NTPC Green Energy increase its wind energy portfolio and reach its goal of adding 60 GW of renewable energy by 2032. This project is very important for Suzlon. It shows that Suzlon is back to working with big government energy companies. The company said this is a proud moment and a big step for clean energy in India. The project will also help Gujarat become a leader in renewable energy. Suzlon will not only supply the turbines, but also take care of the full setup—this includes transporting, installing, testing, and maintaining the turbines. The company said it will make sure the project is completed on time and of high quality. This project also supports the Indian government’s “Make in India” plan. The turbines will be made in India using local factories and workers. This will boost local jobs and technology. Suzlon’s total order book is now close to 5,000 MW as of September 3, 2024, because of this big deal. Suzlon’s Vice Chairman, Girish Tanti, said this is a strong partnership with NTPC Green Energy and a big milestone for both companies. Suzlon’s CEO, JP Chalasani, said this is just the beginning and more big projects will come in the future. In short, this is a historic project for Suzlon and India’s renewable energy journey. It will help reduce pollution, create jobs, and support clean energy for millions of people.

Analyst Insights:

- Market capitalisation: ₹ 69,329 Cr.

- Current Price: ₹ 51.2

- 52-Week High/Low: ₹ 86.0 / 37.9

- P/E Ratio: 59.2

- Dividend Yield: 0.00%

- Return on Capital Employed (ROCE): 24.9%

- Return on Equity (ROE): 28.8%

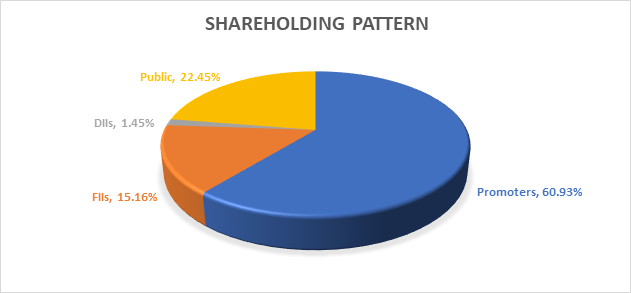

Suzlon Energy is doing well. Its sales and profit have grown more than 90% compared to last year. The company has many new orders. It is also working better and faster now. Suzlon has reduced its debt. Because of this, it pays less interest. Its profit margins are also better. The company is focusing on clean energy, which has good future demand. But the stock is expensive now. It is trading at a high P/E of 59.2 and 15 times its book value. This means the price may be too high at the moment. There are some other problems. Promoter holding is only 13.2%, which is low. The company does not give dividends. Also, debtor days have increased from 125 to 161, which means it takes longer to get money from customers. When we compare with other companies like Inox Wind and Orient Green, Suzlon’s ROCE and ROE are lower. This means it uses money less efficiently than others. In the long term, Suzlon has good chances because of the clean energy market. But now the price is high, and there are some risks. So, it is better to hold the stock or sell some part and book profit, especially if you bought it at a lower price.