Why Adani Wilmar Shares Plunged: Key Reasons Behind the 9.2% Drop and Stake Sale Impact

Adani Wilmar Ltd. fell sharply 9.2% on the last trading day (Friday) to a one-day low of ₹291 on NSE. The fall came after one of its promoters, Adani Commodities LLP, announced a sale of up to 20% holding. The company submitted an offer (OFS) in this month (January 2025).

Strategic transformation by Adani Group

The share sale is in line with Adani Group’s broader strategy to exit non-core businesses. and focus on core infrastructure businesses including airports, roads, data centers, and green hydrogen. Sales generated a revenue of approximately Rs. 485 Cr., among these key activities. It will be a repeat investment.

Parent company Adani Enterprises plans to phase out Adani Wilmar. In the first phase, 13.5% of the shares will be sold through OFS, while in the second phase, Singapore’s Wilmar International Ltd will acquire the remaining shares at a price not exceeding ₹305 per share.

Impact on the market and shareholder changes

OFS has attracted huge interest from over 100 domestic and international investors, making it one of the largest OFS transactions in the recent history of the Indian capital market. The sale announcement, coupled with pressure in the broader market, sent shares of Adani Wilmar down 10% in price.

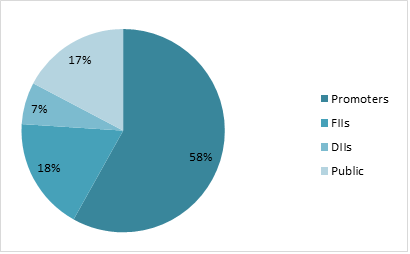

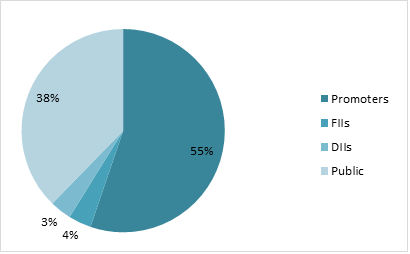

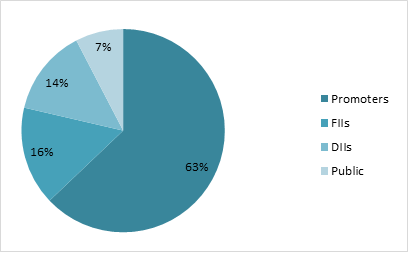

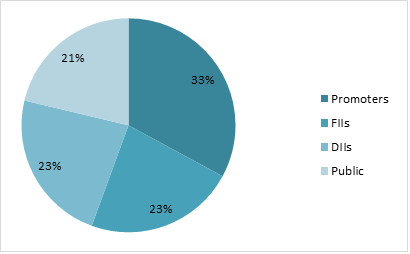

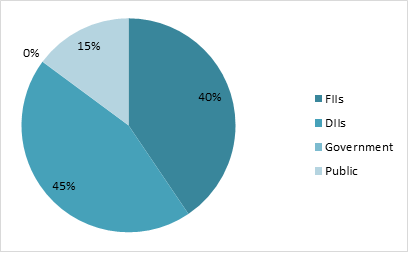

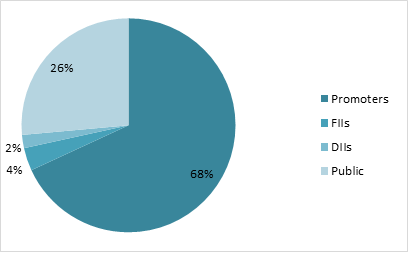

Investor structure after OFS: Adani Group’s stake in the joint venture decreased from 43.94% to 31.06% after the transaction, while Wilmar International It is set to purchase the remaining shares by March 2025.

Compliance and Finance

The sale of Adani Wilmar’s shares ensures compliance with Sebi’s minimum public shareholding (MPS) norms, which require public ownership of at least 25% in a listed entity. After OFS, public shareholders hold shares at 25.63%, while promoters hold 74.37% of the shares.

Business overview and growth trends

Adani Wilmar, an equal joint venture between Adani Group and Wilmar International, dominates the Indian FMCG sector with its flagship brand Fortune, which produces cooking oil, wheat flour, rice, and sugar. The company posted consolidated revenue of Rs 51,555 crore last fiscal year as on date. At the last update, it also reported a market capitalization of ₹42,000 crore.