Zomato Q2 Earnings: Net Profit Jumps 389% YoY, ₹8,500 Crore Fundraising via QIP Approved

Company Overview

Zomato ltd. is a leading Indian online food delivery and restaurant discovery platform with a market capitalization of Rs 200,000+ crore. Founded in 2008, Zomato has grown to become one of India’s most prominent food-tech companies, connecting millions of users with restaurants and delivery services across the country. It has over 17 million monthly active users all over world and 300,000+ delivery personnel. In 2022, Zomato acquired Blinkit as a subsidiary for approx. Rs 4440 crore. It specializes in quick commerce for fast delivering groceries, etc.

Industry Outlook

The Indian e-commerce food delivery industry is poised for strong growth in FY25, driven by increasing consumer demand, digital adoption, and expansion into Tier 2 and Tier 3 cities. Indian food delivery market is expected to grow at a CAGR of 18-20% over the next few years, reaching an estimated ₹1 trillion by FY25. This trend is expected to continue, with more people opting for the convenience of ordering in.

Segmental Information

- Food Delivery: It is a food ordering and delivery platform where customers can search and discover local restaurants, order food, and have it delivered reliably and quickly and it is a core segment of this company.

- Quick Commerce: It offers a quick delivery services to its customers for various categories of products like stationery, fruits, foods, merchandise, electronics item, etc. in delivery time of 15 minutes. And it has acquired a subsidiary called Blinkit, which handles this segment for Zomato.

- Going Out: This segment is a combination of Dining out & ticketing platform where it offers customers to discover a restaurant and reserve it for them and customers can book tickets also for movies or any live shows, etc.

- B2B Supply: The B2B business (Hyper pure) is that, supplying quality food ingredients and other products to restaurants and other B2B buyers.

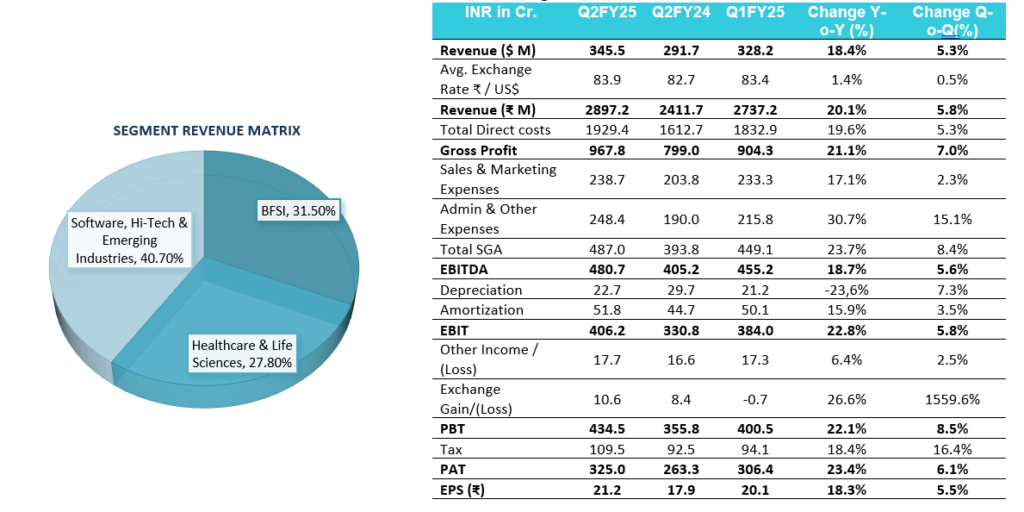

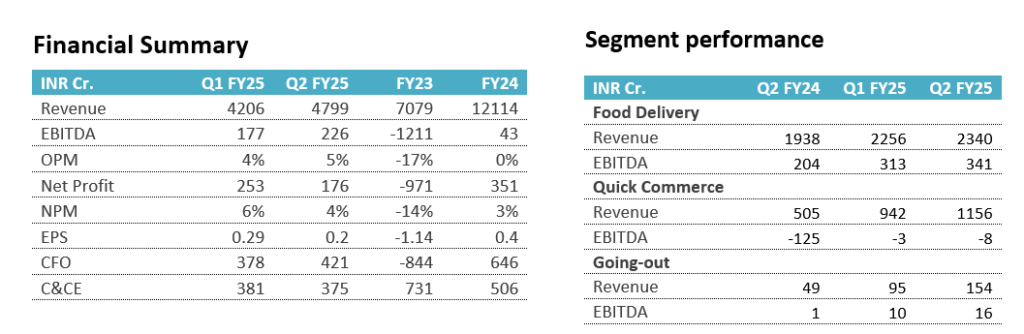

Q2 FY25 Highlights

- Bottom line (EBITDA) continued to improve steadily and Quick commerce business is now near a break-even point.

- Zomato has proposed a fund raising via QIP.

- Food delivery GOV grew 21% YoY (5% QoQ), Quick commerce GOV grew 122% YoY (25% QoQ) and Going-out GOV grew 171% YoY (46% QoQ); total GOV grew 139% YoY (29% QoQ).

- The new District app for going-out business will be live soon in Q3.

- Zomato had average monthly of 20.7 million customers, 292,000 restaurant partners and 500000 delivery partners.

Subsidiary- Blinkit

- It had revenue of Rs 1156 crore compared to 942 crore in Q2FY24, a growth of 129% YoY.

- EBITDA was at break-even level of Rs -8 crore in Q2 FY25 which was Rs -125 crore a year back. Shows a good sign.

- GOV for quick commerce business was Rs 6132 crore and orders for Q2 FY25 were 92.9 million and its average order value is Rs 660, as it offer low price products for daily use and fast delivery.

- The total stores for Blinkit till Q2 are 791 stores and 152 stores were added during this quarter only.

- The GOV per day, per store comes around Rs 981,000 for this quarter.

SWOT Analysis of Zomato

Strengths:

- Diverse revenue streams that enhance financial stability.

- Robust financial backing from investors, enabling expansion.

- Extensive user base, driving consistent engagement.

Weaknesses:

- High operating expenses impacting profitability.

- Intense competitive pressure from other food delivery services.

- Limited international market presence hindering global growth.

Opportunities:

- Expansion potential in Tier 2 and Tier 3 cities.

- Opportunities for partnerships with cloud kitchens to diversify offerings.

- Growing potential for subscription model services to boost customer loyalty.

Threats:

- Increasing competition in the food delivery industry.

- Challenges in consumer retention amidst evolving market dynamics.

- Regulatory risks that could affect operational strategies.