Paytm: SoftBank Completely Exits One 97 Communications by Selling Its 1.4% Stake

Company Overview

One 97 Communications Ltd is a parent entity of Paytm, which was founded in 2000 by Vijay Shekhar Sharma. It is a one of leading payments and financial service platform which has transformed the business offerings in range of digital solutions to customers, merchants and enterprises. In digital payment segment it provides wallet based transactions, UPI, and POS merchant solutions. It provides loans, insurance, wealth management services through its platform. It has newly introduced Paytm Soundbox for merchants and small enterprises. In 2023, it partnered with Amadeus for travelling and ticket booking businesses. The main negative points of company are that its marketing expense is really high and is not performing its operations in compliance with RBI.

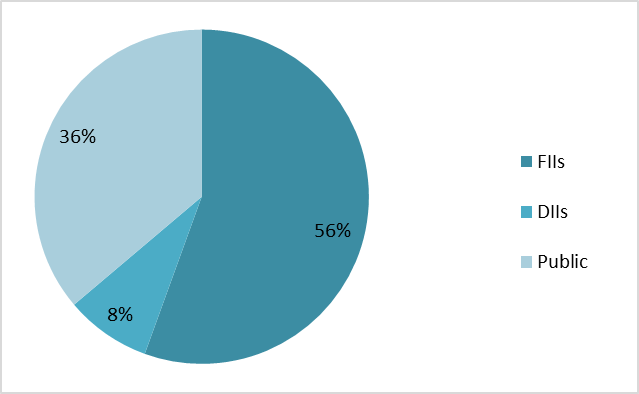

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹62922 Crore |

| Revenue | ₹8278 Crore |

| Profit | ₹-2013 Crore |

| ROCE | -8.4% |

| P/E | – |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | FCF |

| One 97 Comm. | 62972 | 8278 | -2013 | -8.5% | 0.57 | -47.3 | 0.01 | -161 |

| One Mobikwik | 4695 | 875 | 14.3 | 8.96% | 1.12 | 121.17 | 1.38 | -27.6 |

| Info Edge | 112819 | 2662 | 483 | 3.65 | 0.1 | 86.63 | 0.01 | 673 |

| Just Dial | 8566 | 1100 | 311.6 | 4.81% | 0.23 | 19.5 | 0.02 | 245 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 3279 | 2801 | 4974 | 7990 | 9978 |

| Expenses | 5964 | 4640 | 7358 | 9634 | 10921 |

| EBITDA | -2685 | -1838 | -2384 | -1644 | -943 |

| OPM | -82% | -66% | -48% | -21% | -9% |

| Other Income | -45 | 356 | 288 | 410 | 314 |

| Net Profit | -2958 | -1701 | -2369 | -1776 | -1422 |

| NPM | -90.2% | -60.7% | -47.6% | -22.2% | -14.3% |

| EPS | -470.6 | -280.4 | -36.9 | -28.03 | -22.3 |

Stock Price Analysis

The share price has fallen from its IPO price of ₹1600 something to 370-400 per share levels, because of its overvaluation and not proper operations in compliance with RBI has affected the brand value among the retail customers. The share volumes have increased from the past as it has become more volatile stock because of constant news or trending in market. It is at resistance level and might fall from this level.

Latest Stock News

SoftBank has fully exited One97 Communications, the parent company of Paytm, by selling its remaining 1.4% stake. The Japanese conglomerate, which initially held an 18.5% stake during Paytm’s IPO in 2021, gradually reduced its holdings through open-market transactions. This marks the end of SoftBank’s investment in the fintech giant.