Vedant Fashions Reports 37% YoY PAT Growth in Q2, Reaching ₹67 Crore

Company Overview

Vedant Fashions Ltd. is one of India’s leading ethnic wear companies, best known for its flagship brand Manyavar, catering to wedding and celebration wear for men, women, and children. Founded in 2002 and headquartered in Kolkata, Vedant Fashions has grown into a prominent player in India’s organized ethnic wear market, capitalizing on the strong cultural affinity for traditional clothing. The company has a widespread retail network with over 500 exclusive brand outlets across 200+ cities in India. Additionally, Vedant Fashions has expanded internationally, with stores in the USA, UAE, and Canada.

Industry Outlook

The Indian ethnic fashion industry is poised for steady growth, driven by increasing disposable incomes, cultural trends, and a growing preference for branded and organized ethnic wear. The Indian ethnic wear market is expected to grow at a CAGR of around 10% over the next five years, driven by demand for wedding and festival attire. By 2025, the market is projected to reach approximately $20 billion, fuelled by a mix of traditional festivals, weddings, and family celebrations. Additionally, there is rising interest in region-specific attire, which showcases local craftsmanship and heritage.

Segment Information

- Men’s Ethnic Wear: In this segment brands like Manyavar and Twamev are involved to cater a men’s wear segment.

- Women’s Ethnic Wear: For women wear, in this portfolio Mohey brand makes exclusive for wedding and festive wear for women.

- Affordable Wear: To cater for young generations and customers with low price capacity this segment includes Manthan in its portfolio.

- Regional & Multi-Cultural Wear: To provide for cultural preference this segment includes Mebaz in its portfolio collections.

Brands

- Manyavar: Manyavar is their flagship brand contributing major in the revenue of Vedant Fashions. It is into the Men’s and Boy’s shopping categories, at mid-premium spectrum. It is sold through Exclusive Brand Outlet (EBO), Multi Brand Outlet (MBO) and E-commerce.

- Mohey: Mohey is a brand focused on women’s wedding & festive attire, including Lehengas, sarees, gowns and suits.

- Twamev: It is a premium brand that caters to high-end customers with luxury wedding and celebrations wear.

- Manthan: It is an affordable men’s ethnic wear, designed to capture the growing demand among young age populations and price. sensitivecustomers.

- Mebaz: This brand specifically caters to South Indian and multicultural preferences. It is for men, women, and children’s wedding and festive wear.

Quarterly Highlights

- Revenue of Rs 267.9 crore in this quarter, up by 22.7% YoY.

- EBITDA of Rs 121.7 crore up by 27.5% YoY from Rs 95.4 crore in Q2 FY24. At EBITDA margin of 45.4% in Q2.

- Profit is Rs 66.9 crore up by 37.3% YoY from Rs 48.7 crore in Q2 FY24. At PAT margin of 25% in Q2.

Business Highlights

- The company has successfully launched a new festive and celebration wear brand Diwas.

- A new EBO of 4.7k area is rolling out in Q2 FY25.

- Jahnvi Kapoor is onboarded as a new brand ambassador for its women’s wear brand ‘Mohey’.

- Vedant Fashions has no borrowings on its balance sheet; it’s a lease liability, which is money taken in advance for a contract.

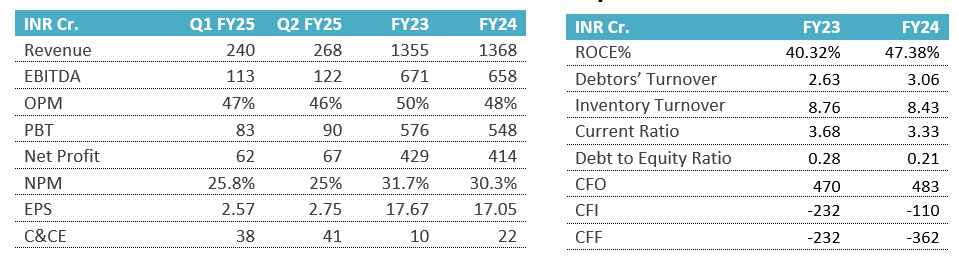

Financial Summary and Key Ratios

SWOT Analysis

Strengths:

- Diverse brand portfolio

- Strong brand recognition

- Focus on premium segment

- Extensive retail network

Weaknesses:

- Seasonal demand fluctuations

- High pricing limits reach

- Limited to ethnic wear

Opportunities:

- Growing digital presence

- Celebrity endorsements

- Focus on regional and cultural apparel

Threats:

- Changing fashion trends

- Intense competition

- Economic downturns impacting spending