TVS Electronics Q2 Earnings: Marking 13.47% Year-on-Year Growth

Company Overview

TVS Electronics Ltd. is a prominent Indian technology solutions provider within the TVS Group, focusing on electronic products and services catering to sectors like retail, banking, and e-governance. Established in 1986 and headquartered in Chennai, TVS Electronics has a strong market presence in India and is known for its wide range of offerings, from hardware manufacturing to after-sales services. The company operates in both B2B and B2C markets, consistently evolving to meet changing consumer and enterprise technology needs. Its service network, covering over 5,000 locations across India, makes it a preferred partner for companies requiring maintenance and repair solutions. The company also acts as a distributor and solution provider for IT peripherals and other electronic products. It has various big global and Indian clients Starbucks, Bharat Petroleum, Amazon, Dell, Acer, HP, Banks like SBI, ICICI, HDFC, etc. then Paytm, PhonePe, etc.

Industry Outlook

The Indian electronics industry is expected to grow at a CAGR of around 16-18% over the next decade, driven by strong domestic demand, robust government support, and increasing interest from global investors. The Indian electronics industry is one of the fastest-growing sectors in the country, driven by rising consumer demand, government initiatives, and foreign investments. India is rapidly evolving from an electronics import-dependent nation to a manufacturing hub, as demand for electronics continues to raise across various sectors, including consumer electronics, automotive, healthcare, and IT hardware. With a focus on both domestic consumption and exports, the industry is projected to see substantial growth in the coming years. India’s electronics demand is anticipated to reach approximately $400 billion by 2025, fuelled by increasing digitization, rising incomes, and a growing middle class. India’s electronic exports are increasing, with mobile phone exports alone reaching $11 billion in FY 2022-23. This trend is supported by the country’s participation in global value chains.

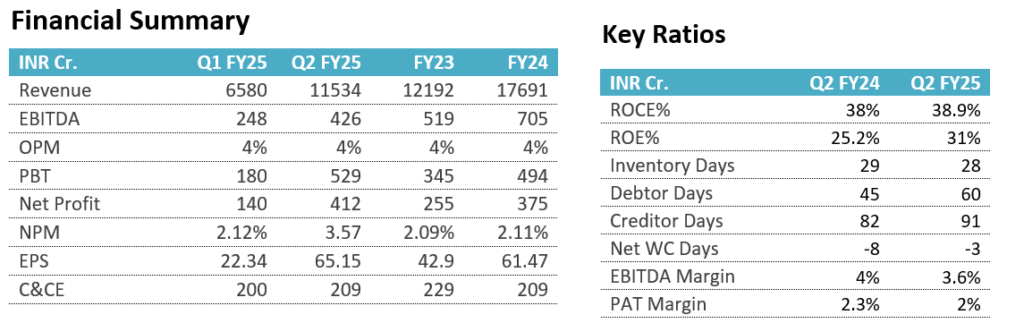

Financial Summary

| INR Cr. | Q1 FY25 | Q2 FY25 | FY23 | FY24 |

| Revenue | 111.32 | 104.61 | 353 | 366 |

| EBITDA | 3.16 | 2.63 | 20 | 10 |

| OPM | 2.84% | 2.51% | 6% | 3% |

| PBT | -1.12 | -1.49 | 13 | -1 |

| Net Profit | -1.26 | -1.32 | 10 | 0 |

| NPM | -1.13% | -1.26% | 2.83% | 0.01% |

| EPS | -0.68 | -0.71 | 5.1 | 0.14 |

| C&CE | 5 | 7 | 11 | 4 |

Business Segments:

- Products & Solutions: It is a core segment of TVS Electronics, it makes printers, cash machines, mobile handsets, keyboards are a major part, then provides software services also. It has clients in segments like retail, manufacturing, healthcare & hospitality, Banking and Financial services, IT, Audio, Solar companies and large government companies are also clients of this company. It also provides a one-stop solution service to its clients. It earned a revenue of ₹73.10 crore in this quarter.

- Customer Support Services: In this segment, company offers after sales support services for many global and Indian clients. Provides field support to consumer electronics, solar customers, electric vehicles, etc. to make it seamless for the company’s clients. It also provides repair and management services for display panels, payment sound boxes and electronics. The in-house CRM platform integrates AI and machine learning capabilities to connect brands, service partners, parts management, and logistics seamlessly.

Q2 FY25 & Business Highlights

- Revenue of ₹104.61 crore in Q2 FY25 up by 13.4% YoY from ₹92.19 crore in Q2 FY24.

- EBITDA of ₹2.63 crore in this quarter at a margin of 2.51% compared to 4.18% in Q2 FY24.

- Loss of ₹-1.32 crore in this quarter compared to a ₹1.12 crore profit in Q2 FY24.

- The Product & Solution segment registered a YoY growth of 8.3% in revenue in Q2FY25 with revenue of ₹ 731 mn.

- The customer support service vertical generated revenue of INR 315 Mn in Q2-FY25, representing an increase of 27.5% YoY and an increase of 15.8% on QoQ basis.

- The top 10 customer concentration is reduced to 30% from 41% in FY20.

- There was also an increase in finance costs on YoY basis, incurred for servicing the loans procured for capital investments and working capital requirements.

SWOT Analysis:

Strengths

- Established Brand with Strong Legacy

- Diverse Product Portfolio

- Extensive Service Network Across India

Weaknesses

- Highly Competitive Market Environment

- Lower Profit Margins

- Heavy Reliance on Domestic Market

Opportunities

- Potential for New Product Line Expansions

- Government Support for Local Manufacturing

- Growing Demand for After-Sales and Support Services

Threats

- Fast-Paced Technological Advancements

- Ongoing Supply Chain Challenges

- Intense Price Competition