Jio Financial Jumps 3% on New Loan Against Securities (LAS) Rollout by NBFC Arm

Business and Industry Overview:

Jio Financial Services Ltd. (JFSL) is an Indian financial services company, based in Mumbai. It helps people take loans, save money, pay bills, do recharges, buy insurance, and invest money. All these services are given through a mobile app called JioFinance. People can use the app to manage their money easily. The company wants to make money services simple for all people in India. JFSL started in 1999 with the name Reliance Strategic Investments Private Limited. Later, the name changed to Reliance Strategic Investments Limited in 2002. In 2023, it became Jio Financial Services Ltd. after it separated from Reliance Industries. It got listed on the stock market (BSE and NSE) on 21 August 2023. JFSL is registered with the Reserve Bank of India as a Core Investment Company. It runs its services through companies like Jio Finance Ltd., Jio Insurance Broking Ltd., Jio Payment Solutions Ltd., Jio Leasing Services Ltd., Jio Finance Platform and Services Ltd., and Jio Payments Bank Ltd. JFSL also works with BlackRock, the world’s biggest asset manager. Together they give services like money investment, wealth management, and broking. JFSL wants to help every Indian become strong in money matters using mobile and online tools. The company wants to grow with India and give good returns to people who trust and invest in it.

Latest Stock News:

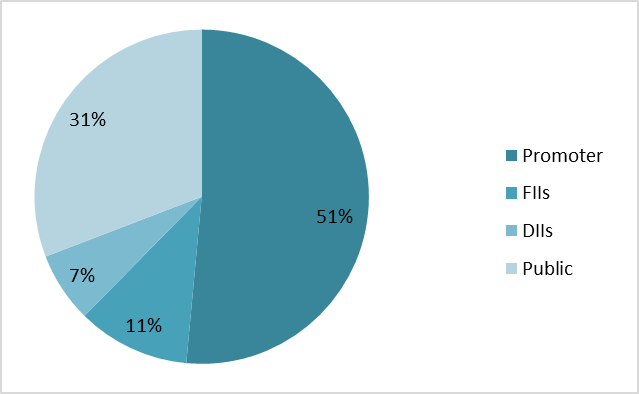

As of April 9, 2025, Jio Financial Services Ltd. (JFSL) is trading at ₹220.92 per share, with a market value of around ₹1,40,385 crore. The stock saw a small drop today. This matches the overall market mood and how investors reacted to recent news. A day earlier, on April 8, JFSL shares jumped 5.38% in the last hour of trading and hit ₹225. It ended the day at ₹224.40, up 5.11%. This big jump happened because Jio Finance Ltd, its NBFC arm, launched a new digital Loan Against Securities (LAS) service. This service gives loans up to ₹1 crore in just 10 minutes, using shares or mutual funds as security. Interest starts from 9.99%, with a loan time of up to 3 years and no early closing charges. The company said this is part of their plan to give fast, easy, and digital financial help to people. Even with this rise, the stock is still down 26.31% in 2025. The stock is trading below many moving averages (5-day to 200-day). Its RSI is 48.56, which shows it is not overbought or oversold. The stock has a high P/E of 256.15, P/B of 5.47, EPS of 0.83, and RoE of 2.13. Its one-year beta is 1.3, which means it is quite volatile. As of December 2024, promoters owned 47.12% of the company, which is backed by Reliance Industries.

Potentials:

Jio Financial Services wants to help people with money matters in a simple way. It has many future plans. First, it will start giving insurance with a German company called Allianz. This will help people protect their health, family, and things they own. Second, it will work with a big U.S. company called BlackRock. Together, they will help people save and grow their money through mutual funds and other tools. Third, Jio will start renting phones and internet devices to people. It will buy these devices from Reliance Retail and give them on rent to customers. Fourth, Jio has started a new service called Loan Against Securities (LAS). With this, people can get a loan in just 10 minutes by using their shares or mutual funds as security. They can take up to ₹1 crore at low interest, and they don’t have to pay extra if they close the loan early. Jio wants to give all these services in a digital and easy way. People can use their phone to get loans, invest, and more. The aim is to make money help simple, fast, and for everyone in India.

Analyst Insights:

- Market capitalisation: ₹ 1,40,344 Cr.

- Current Price: ₹ 221

- 52-Week High/Low: ₹ 395 / 199

- Stock P/E Ratio: 87.3

- Dividend Yield: 0.00%

- Return on Capital Employed (ROCE): 1.55%

- Return on Equity (ROE): 1.27%

Jio Financial Services Ltd (JFSL) is growing fast. Its revenue went up from ₹45 crore in 2023 to ₹1,855 crore in 2024. Its profit also increased from ₹31 crore to ₹1,605 crore. This shows strong business growth. The company has almost no debt, which is good. It also became more efficient. Its working capital days reduced from 1,832 to just 20.6 days. This means it is using money better. The company’s profit margin is also high at 80%. It keeps more money as profit after costs. JFSL is part of Reliance Group, which gives it strong support and trust.

The company is starting new services. It is working in loans, insurance, and payments. It started a digital loan service called “Loan Against Securities.” Customers can use shares or mutual funds to get loans in just 10 minutes. The loan amount can go up to ₹1 crore. This shows JFSL is using technology to grow and make services easy.

But there are also some risks. The return on equity (ROE) is 1.27% and ROCE is 1.55%. These are low. It means the company is not using its money very well yet. The stock is expensive. The price-to-earnings ratio (P/E) is high at 87.3. This means the stock costs more than its earnings. The stock has also gone down 26% in 2025 till now. It is trading below many moving averages. This shows weak performance in the short term.

So, the company has good plans and strong growth. It is safe and backed by Reliance. But right now, returns are low and the stock is costly. Investors should wait and watch how the company performs in the coming quarters.