PB Fintech Stock Plunges 6% to INR 1,706 Amid Market Volatility

Overview

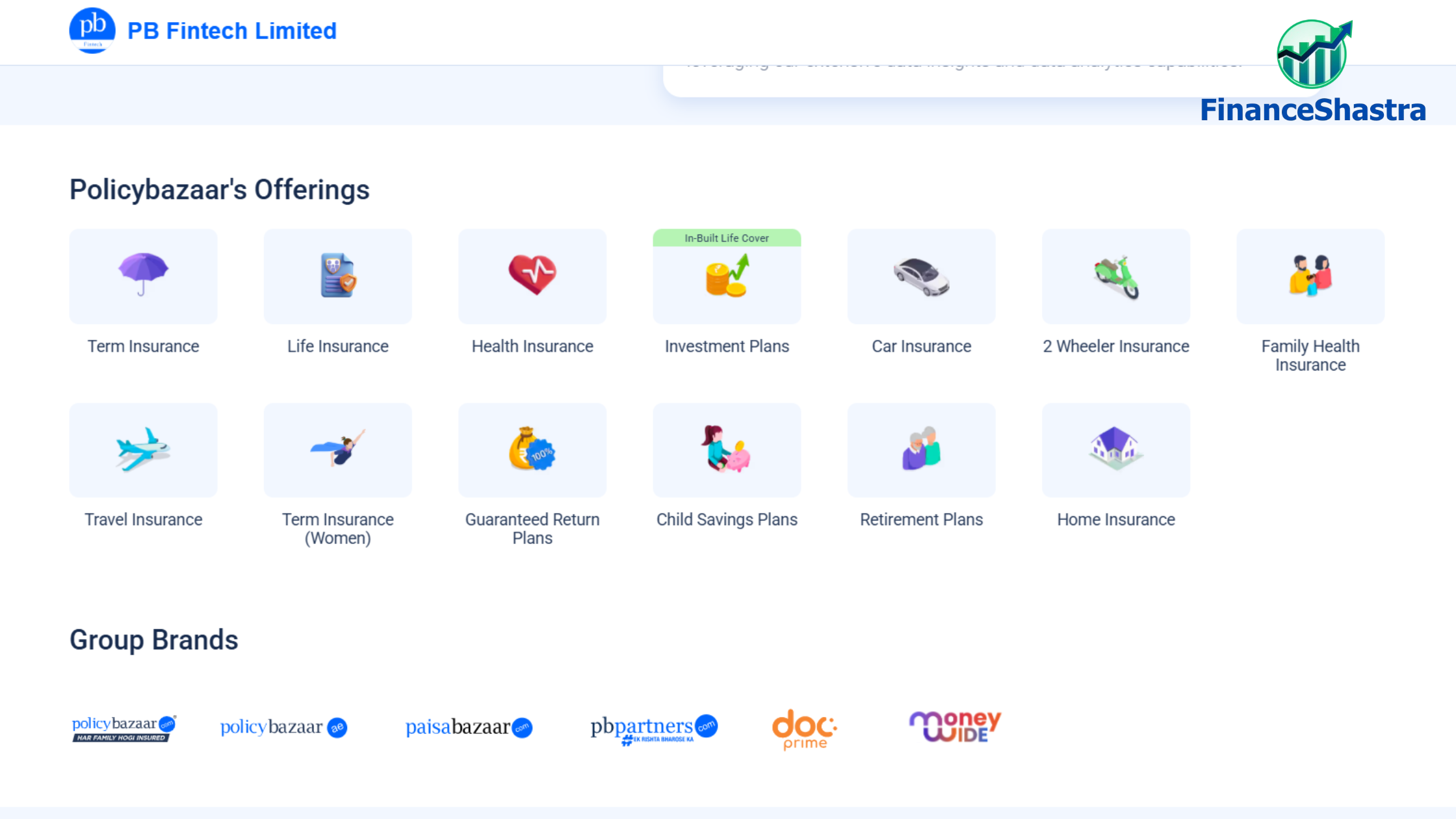

PB Fintech, the parent company of Policybazaar and Paisabazaar, is a leader in India’s insurance and fintech sectors. The company is known for leveraging technology to simplify insurance, loans, and other financial services for consumers. To expand its market presence, it has actively diversified into new segments, including healthcare and payment aggregation.

Despite strong financial growth and a positive long-term outlook, PB FinTech shares have recently faced trouble due to valuation concerns, regulatory inspections, and the challenge of seeing profits.

Latest News

- Intraday Decline: The stock nosedived by 6% to INR 1,706 during intraday trading on January 17 but recovered slightly to trade at INR 1,718.65 (-5.1%) by 12:20 PM.

- Brokerage Downgrade: Morgan Stanley downgraded the stock from “equal-weight” to “underweight,” citing lower profit emergence and high valuations, with a price target of INR 1,400 (14% downside).

- GST Raid: A subsidiary of PB Fintech was recently raided by the GST department in connection with vendor inquiries.

- Diversification Efforts:

- Entered the healthcare segment via PB Healthcare Services Private Limited on January 2.

- Expanded into the payment aggregator space with PB Pay in 2024.

- Received an RBI account aggregator license for PB Financial Account Aggregator Private Limited in October 2024.

- Tax Relief: On January 4, PB Fintech received relief on a tax dispute, saving INR 166.12 Cr for FY 2015-16.

Financial summary

- Market Capitalization: INR 78,923.99 Cr (as on 17 January 2025)

- Latest stock performance:

- Monthly return: -19% .

- Annual return: +94.67%

- Weekly Fall: -16.2% last week (The second biggest loser among 31 tracked technology stocks)

- Highlights of Q2 FY 2025:

- Net Profit: INR 50.98 Trillion (Loss INR 21.11 Trillion in Q2FY)

- Operating income: INR 1,167.2 Cr (+43% YoY from INR 811.6 Cr)

- 4th quarter continues to make profits

- Important events: It entered the healthcare sector and touched an all-time high of Rs 2,254.95 on January 3, 2025.

PB Fintech’s long-term potential remains strong, fueled by diversification and revenue growth. However, short-term market challenges and valuation concerns are weighing on investor sentiment.