Divi’s Laboratories Q2 FY25 Results: Net Profit Soars 47% Amid Strong Performance

Company Overview

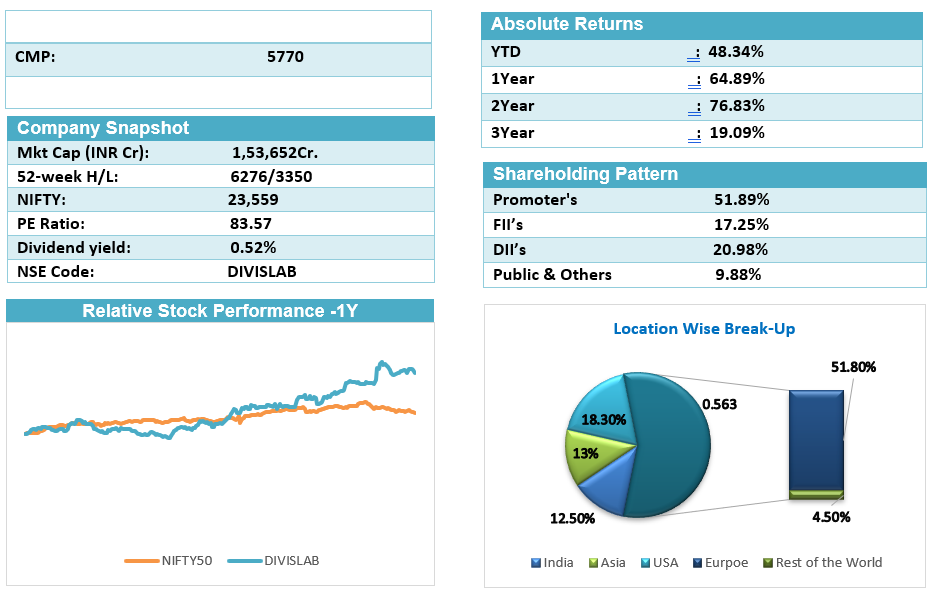

Divi’s Laboratories Ltd., a major global API (Active Pharmaceutical Ingredients) manufacturer, was founded in 1990 as Divis Research Center, focusing initially on Research & Development. Today, it stands as one of the largest API companies worldwide, specializing in Intermediates, Nutraceuticals, and custom synthesis for innovator pharmaceuticals. It has a significant export-oriented business, with a presence in over 100 countries, supplying around 160 diverse products. Divi’s Laboratories Ltd. has achieved significant milestones in its growth and operations. In 1995, the company established its first manufacturing unit in Choutuppal near Hyderabad. Over the years 1997-2001, it earned ISO-9002 and OHSAS-18001 certifications, underlining its commitment to quality and safety standards. By 2002, Divi’s expanded further with a second manufacturing facility at Chippada, Visakhapatnam, which later became an Export Oriented Unit (EOU), enhancing global reach.

In 2006-2008, the company developed Divi’s Pharma SEZ in Visakhapatnam for Nutraceutical production, expanding its custom synthesis and Nutraceutical portfolio to meet rising export demand. In 2011, Divi’s launched the DSN SEZ Unit at Visakhapatnam, increasing production capacity in generic and custom synthesis segments.

From 2014-2018, Divi’s Laboratories passed multiple international regulatory inspections, including from the US FDA and COFEPRIS (Mexico), establishing EIR status for Unit-II, Visakhapatnam, which addressed previous regulatory concerns. The company invested ₹1200 crore in 2019-2020 in brownfield projects, creating DC SEZ and DCV SEZ units that became fully operational in FY2021. These projects boosted Divi’s role in generic and big pharma markets. In 2023, Divi’s launched Unit-III in Kakinada, Andhra Pradesh, further expanding production capacity.

In line with its dedication to innovation and compliance, Divi’s has research centers in Hyderabad and at manufacturing sites, focusing on custom synthesis and process innovations. With two subsidiaries—Divi’s Laboratories (USA) Inc. and Divi’s Laboratories Europe AG in Switzerland—the company enhances its reach in Nutra product markets. Divi’s continued investments in R&D, global regulatory compliance, and strategic expansion reinforce its commitment to high-quality pharmaceutical solutions, positioning it as a prominent player in the global API market.

Financial Overview

Industry Outlook

The Indian pharmaceutical sector is experiencing both near-term challenges and long-term growth potential driven by strategic expansions, cost efficiency, and new market opportunities. Key factors impacting the sector include pricing pressures in generic products and logistics challenges due to disruptions like the Red Sea crisis, which has extended shipping times and increased costs. Many companies are proactively managing inventory and supply chains to mitigate these impacts, such as advancing shipments and diversifying supply sources.

In the generic business, pricing pressure remains a challenge, but there is healthy volume growth in base businesses. Companies are expanding their portfolio to address loss of exclusivity (LOE) for several drugs, projected for 2026, which opens opportunities to capture market share in high-value molecules. This trend aligns with the pharmaceutical sector’s increasing focus on specialty and complex products and API (Active Pharmaceutical Ingredient) markets, which are seeing robust demand.

Custom synthesis continues to drive growth, with rising demand from both new and existing customers. Many companies have expanded into contrast media manufacturing, particularly iodine- and gadolinium-based molecules, which present a growing opportunity in global diagnostic markets with an annual growth rate of around 10-15%.

The API sector is well-positioned for sustained growth as global companies look for reliable alternative suppliers due to changing procurement strategies. With recent capacity expansions across SEZ units in India, companies can leverage low input costs in areas like raw materials, freight, and power to enhance profit margins. As inflation moderates globally, Indian pharmaceutical companies may also benefit from cost rationalization strategies, improving their competitiveness.

Divi’s Laboratories and other Indian firms are positioned to capitalize on the long-term trend of increased API demand and are exploring new opportunities in contract media and GLP-1 products. As the global addressable market for contrast media grows (estimated at USD 4-6 billion), firms expanding in this space can anticipate sustained demand for innovative and cost-effective solutions. Meanwhile, backward integration and advanced R&D capabilities are key strategies, enabling companies to streamline production costs and strengthen market positions over the long term.

In summary, while near-term challenges like pricing pressure and logistics disruptions persist, the pharmaceutical sector’s shift toward specialty products, cost-efficiency, and expanded capacities paints a promising outlook for the long-term. Indian companies’ strategic investments in innovation, compliance, and operational efficiency will likely enable them to maintain double-digit revenue growth while meeting the increasing demands of the global pharmaceutical market.

Business Segments

Divi’s Laboratories has demonstrated strong segmental performance across several key areas, including generic APIs, custom synthesis, peptides, contrast media, and ongoing capacity expansions at strategic units. Each of these segments reflects the company’s focus on meeting growing demand while managing industry challenges such as pricing pressures and supply chain disruptions.

- Generic APIs: Divi’s generic business has experienced healthy double-digit volume growth, although pricing pressure persists across the industry. Despite the pricing environment, Divi’s has expanded its market share in smaller API molecules, highlighting the company’s resilience and strategic positioning in the generic segment. Emerging generic products have also shown robust performance, underscoring Divi’s adaptability in a competitive space.

- Custom Synthesis: There is a notable increase in demand for Divi’s custom synthesis services from both new and existing clients. The future pipeline for this segment appears strong, with a robust set of products advancing through various stages of development. Key contributions from this segment are expected to start from FY26, aligning with the company’s long-term growth vision.

- Peptides: Divi’s Laboratories has placed significant emphasis on GLP-1 compounds within the peptide segment, focusing on solid-phase synthesis to meet customer-specific requirements. The company is also expanding capacities for these peptide products, especially for solid-based peptides used in GLP-1 fragments, a growing therapeutic area. This focus enhances Divi’s specialty offerings, enabling it to cater to high-demand, niche markets.

- Contrast Media: The contrast media segment has delivered impressive results, with volume growth of 20-30% YoY. Divi’s engagement with major clients in this area is progressing, with various projects moving to advanced stages. The company is actively working on iodine-based molecules (some nearing commercialization) and gadolinium-based molecules (in qualification stages, with potential for commercialization by FY26/27). Increased RFPs (Request for Proposals) from customers in this segment underscore the growing demand for Divi’s contrast media products.

- Kakinada Unit (Unit-III): Divi’s Greenfield expansion at Kakinada is progressing as planned, with Rs. 11.8 billion spent as of H1 FY25. Production is set to commence in December 2024 in a phased manner. This unit is part of Divi’s strategy to expand capacity for both regulatory and custom synthesis products, supporting future growth in demand.

- Logistics and Supply Chain: Divi’s has been proactive in managing inventory and logistics challenges, particularly those arising from the Red Sea disruptions that increased transit times to 70 days. The company has addressed these challenges by advancing shipments by 3-4 weeks and maintaining higher safety stock to minimize supply interruptions.

Key Subsidiaries and Their Information

Divi’s Laboratories operates through two major subsidiaries, Divis Laboratories (USA) Inc. and Divi’s Laboratories Europe AG. These subsidiaries play a strategic role in the company’s global expansion and focus on specialized markets for pharmaceutical ingredients, particularly in custom synthesis and nutraceuticals.

- Divis Laboratories (USA) Inc.: This subsidiary caters primarily to the North American market, focusing on the distribution and marketing of nutraceutical products and custom synthesis services. It helps Divi’s Laboratories establish a strong presence in the US, one of the largest pharmaceutical markets globally, and aligns with Divi’s mission to support local customer requirements while meeting stringent regulatory standards. It contributes significantly to the company’s nutraceutical portfolio growth and has enhanced relationships with major pharmaceutical clients by providing reliable supply chains and custom synthesis offerings tailored to local industry needs.

- Divi’s Laboratories Europe AG (Switzerland): This subsidiary focuses on European markets, providing nutraceutical and pharmaceutical ingredients and supporting custom synthesis projects for clients in Europe. Divi’s Laboratories Europe AG serves as a critical hub for European operations and facilitates compliance with EU regulatory standards. It also strengthens Divi’s supply chain resilience by creating a local presence in Europe, enhancing service delivery and customer support. In FY25, Divi’s Laboratories Europe AG has seen robust demand in nutraceuticals, particularly for ingredients with high-quality standards essential for the European market. This subsidiary plays a key role in Divi’s market penetration in Europe, contributing to the company’s overall revenue growth.

These subsidiaries support Divi’s Laboratories’ strategic goals of expanding its global footprint and catering to diverse regional needs in the pharmaceutical and nutraceutical industries. They also provide a platform for Divi’s to directly engage with key markets, ensuring regulatory compliance, effective supply chains, and tailored customer support, aligning with the company’s vision of global operational excellence.

Q2 FY25 Highlights

- Divi’s Laboratories reported consolidated total income of ₹2,444 crore, a 22.5% increase compared to ₹1,995 crore in the same quarter of the previous year. For the half-year ended 30th September 2024, Divi’s Laboratories posted a consolidated total income of ₹4,640 crore, up by 20.4% from ₹3,854 crore in the same period of the previous year. This consistent revenue growth reflects the company’s ability to expand its product portfolio and global footprint.

- Profit Before Tax (PBT) for the quarter was ₹722 crore, a substantial rise of 54% from ₹469 crore in the corresponding period last year. This increase in PBT highlights improved profitability driven by efficient operations and cost management. The PBT for the half-year was ₹1,326 crore, up from ₹961 crore, marking a 38% increase.

- Profit After Tax (PAT) for the quarter stood at ₹510 crore, showing a significant 46.6% growth compared to ₹348 crore in the previous year. This reflects the company’s strong bottom-line performance, driven by both operational growth and improved cost efficiencies. PAT for the half-year was ₹940 crore, a significant 33.5% increase from ₹704 crore in the corresponding period of the previous year, reflecting robust operational performance and better margins.

- The company also reported a foreign exchange (forex) gain of ₹29 crore for the quarter, which is a notable increase from the ₹1 crore gain recorded in the same quarter of the previous year. The company also recorded a forex gain of ₹28 crore for the half-year, compared to ₹14 crore in the previous year, further contributing to the positive financial results. The forex gain likely provided additional support to the bottom line.

- Greenfield expansion at Kakinada Unit(III) is progressing as planned, with Rs. 11.8 billion spent as of H1 FY25. Production is set to commence in December 2024 in a phased manner. This unit is part of Divi’s strategy to expand capacity for both regulatory and custom synthesis products, supporting future growth in demand.

- Divi’s has been proactive in managing inventory and logistics challenges, particularly those arising from the Red Sea disruptions that increased transit times to 70 days. The company has addressed these challenges by advancing shipments by 3-4 weeks and maintaining higher safety stock to minimize supply interruptions.

Financial Summary

| INR in Cr. | Q2FY25 | Q1FY25 | Q2FY24 | Q-o-Q (%) | Y-o-Y (%) |

| Revenue from Operation | 2,338 | 2,118 | 1,909 | 10% | 22% |

| Other Income | 106 | 79 | 86 | 34% | 23% |

| Total Income | 2,444 | 2,197 | 1,995 | 11% | 23% |

| Total Expenditure | 1,622 | 1,496 | 1,430 | 8% | 13% |

| Operating profit | 716 | 622 | 479 | 15% | 49% |

| Other Income | 106 | 79 | 86 | 34% | 23% |

| Interest | 1 | 0 | 1 | 0% | 0% |

| Depreciation | 99 | 97 | 95 | 2% | 4% |

| PBT | 722 | 604 | 469 | 20% | 54% |

| PAT | 510 | 430 | 348 | 19% | 47% |

| EPS (Rs.) | 19.2 | 16.2 | 13.11 | 19% | 46% |

SWOT Analysis: Key Insights

Strengths

- Market Leadership: Strong foothold in the industry with a leading market position.

- Robust Manufacturing: Advanced manufacturing capabilities that ensure high-quality production.

- Research Focus: Commitment to R&D fuels innovation and keeps the company competitive.

- Outstanding Performance: Consistently strong financial and operational performance.

Weaknesses

- Regulatory Risks: Exposure to regulatory changes can impact business operations.

- High Dependency on API: Reliance on active pharmaceutical ingredients (API) poses risks.

- Limited International Reach: Lack of significant presence in global markets limits growth potential.

Opportunities

- Rising Global Demand: Increasing demand for pharmaceutical products worldwide.

- New Product Development: Expanding product lines can capture new market segments.

- Technological Innovations: Leveraging technology to enhance production and product quality.

Threats

- Price Pressure: Competitive pricing in the market can impact profit margins.

- Intense Competition: Facing stiff competition from both domestic and international players.

- Supply Chain Vulnerabilities: Disruptions in the supply chain could affect operations.